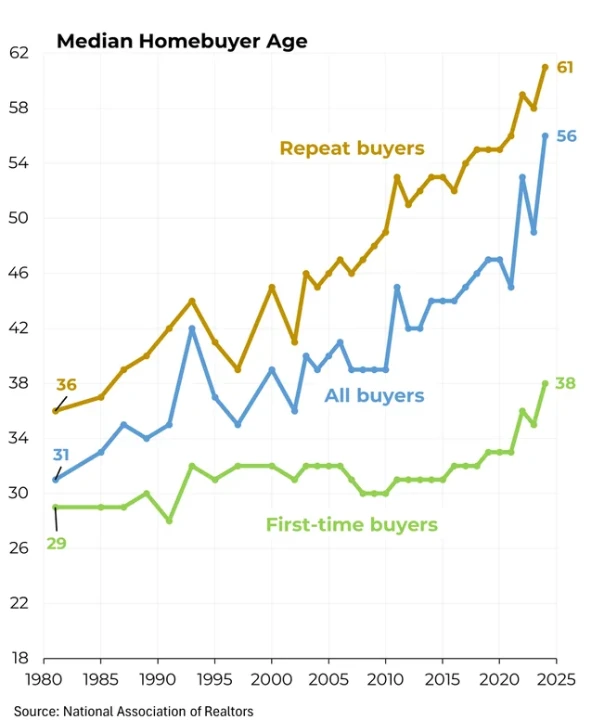

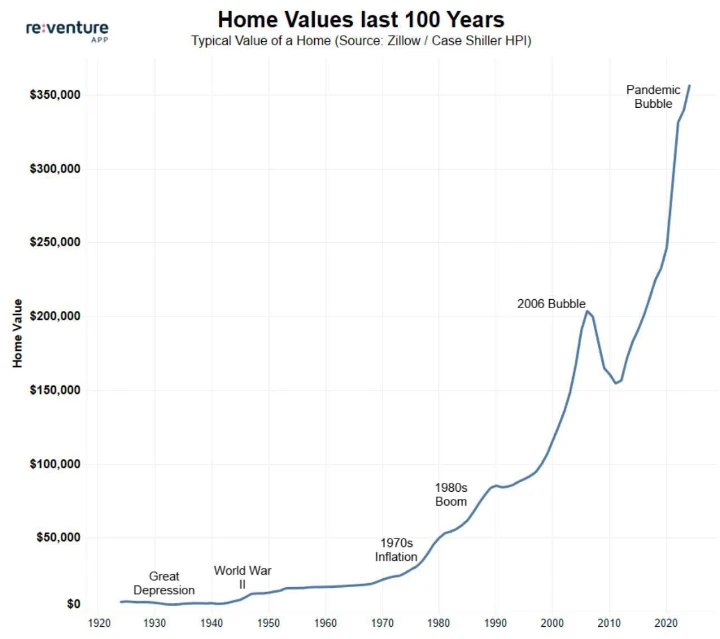

Between 2008 and 2020 surely was the easiest time to bu houses, it's not even close. Not only did prices collapse after the GFC, but interest rates were near zero and super easy to get loans

ADRIATIC METALS PLC Chat

A Adriatic Metals Plc

ASX:ADT

Australia

Revenue: 27.6m

$0.0/sec