Why Spend Over $400m Building This Wa Rare-Earth Mine?

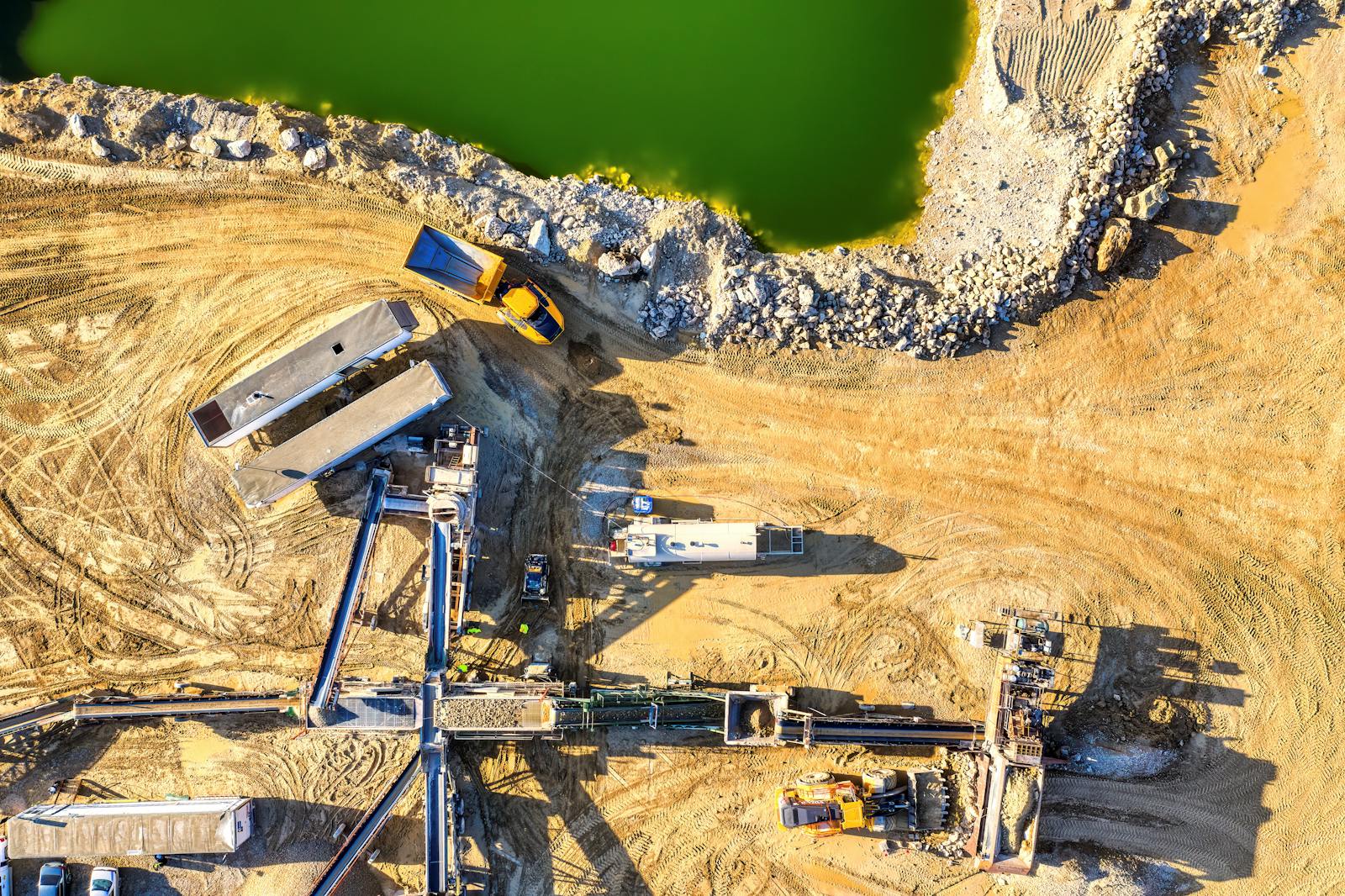

Around 1,000 Kilometres North Of Perth, The Yangibana Rare-Earths Project Is Aiming To Become One Of Australia’S Key Suppliers Of Neodymium And Praseodymium (Ndpr) — Metals Used In Electric-Vehicle Motors, Wind Turbines And Defence Technology. The Site Sits In The Gascoyne Region, Far From Major Towns But Close To Some Of The Country’S Best Rare-Earth Geology.

Backed By Hastings And Wyloo

The Project Is Being Advanced By Hastings Technology Metals, With Major Backing From Andrew Forrest’S Wyloo. Together They Are Working On A $470 Million Development Plan To Build The Mine And Processing Facilities Needed To Produce High-Grade Concentrate.

A Us Supply Chain In The Making

Yangibana Is Designed To Export Around 37,000 Tonnes Of Rare-Earth Concentrate Per Year. A Key Part Of The Strategy Is Feeding New Downstream Processing Capacity In The United States, As Global Manufacturers Look To Secure Non-Chinese Sources Of Critical Minerals For Clean-Energy Technologies.

Funding Remains The Final Hurdle

While Early Works Have Already Begun And Government Agencies Have Provided Loan Support, The Project Still Needs To Secure Its Remaining Capital Before Full Construction Can Move Ahead. That Leaves A Central Question For Investors And Policymakers Alike: Is Yangibana Finally Close To Becoming A Reality?

ASX:HAS

ASX:HAS