B Black Cat Syndicate Limited

ASX:BC8

Australia

400

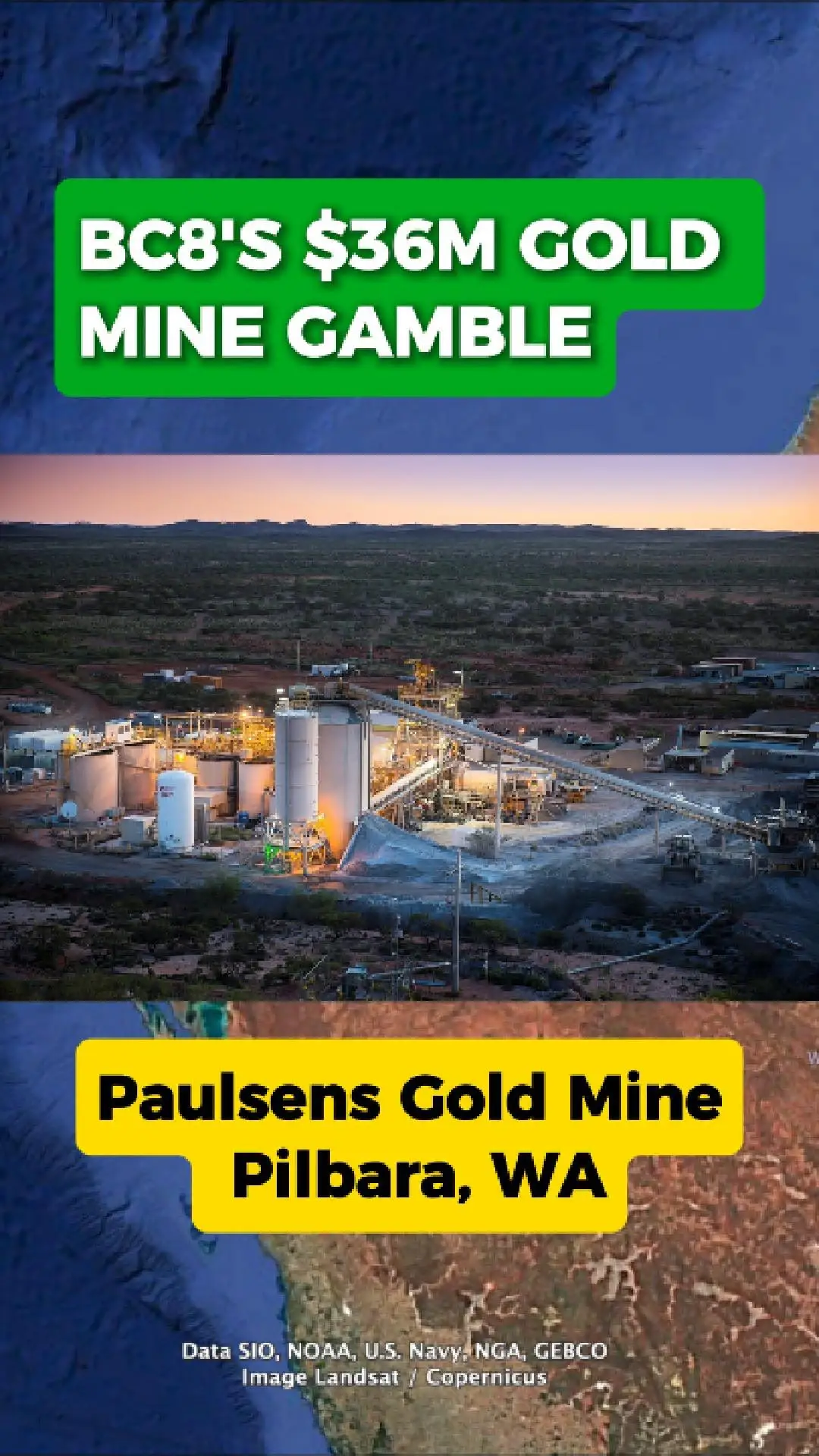

Black Cat hits 100,000oz run-rate in 12 months as Paulsens and Kal East deliver $BC8 a record quarter