$TNC

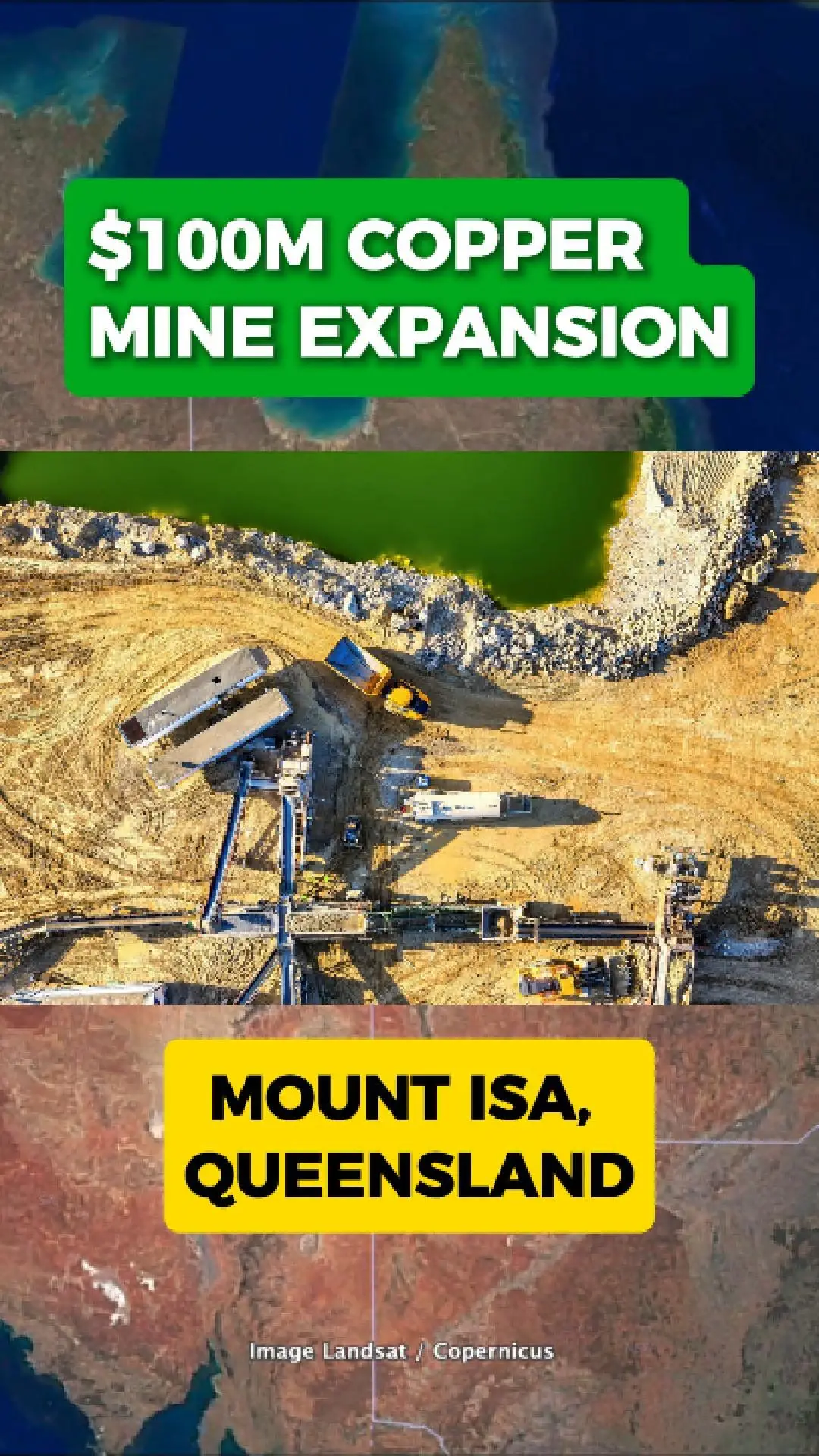

Cloncurry’s Historic Copper Mine Fires Back Up

Cloncurry, one of Australia’s oldest copper towns, is seeing renewed activity as True North Copper restarts operations at the historic Great Australia Mine. The site, which has been idle for several years, is once again becoming a key focus for regional development.

Fresh Drilling Confirms ...

Cloncurry, one of Australia’s oldest copper towns, is seeing renewed activity as True North Copper restarts operations at the historic Great Australia Mine. The site, which has been idle for several years, is once again becoming a key focus for regional development.

Fresh Drilling Confirms ...

$TNC

💬 Community Insight (via Threads)

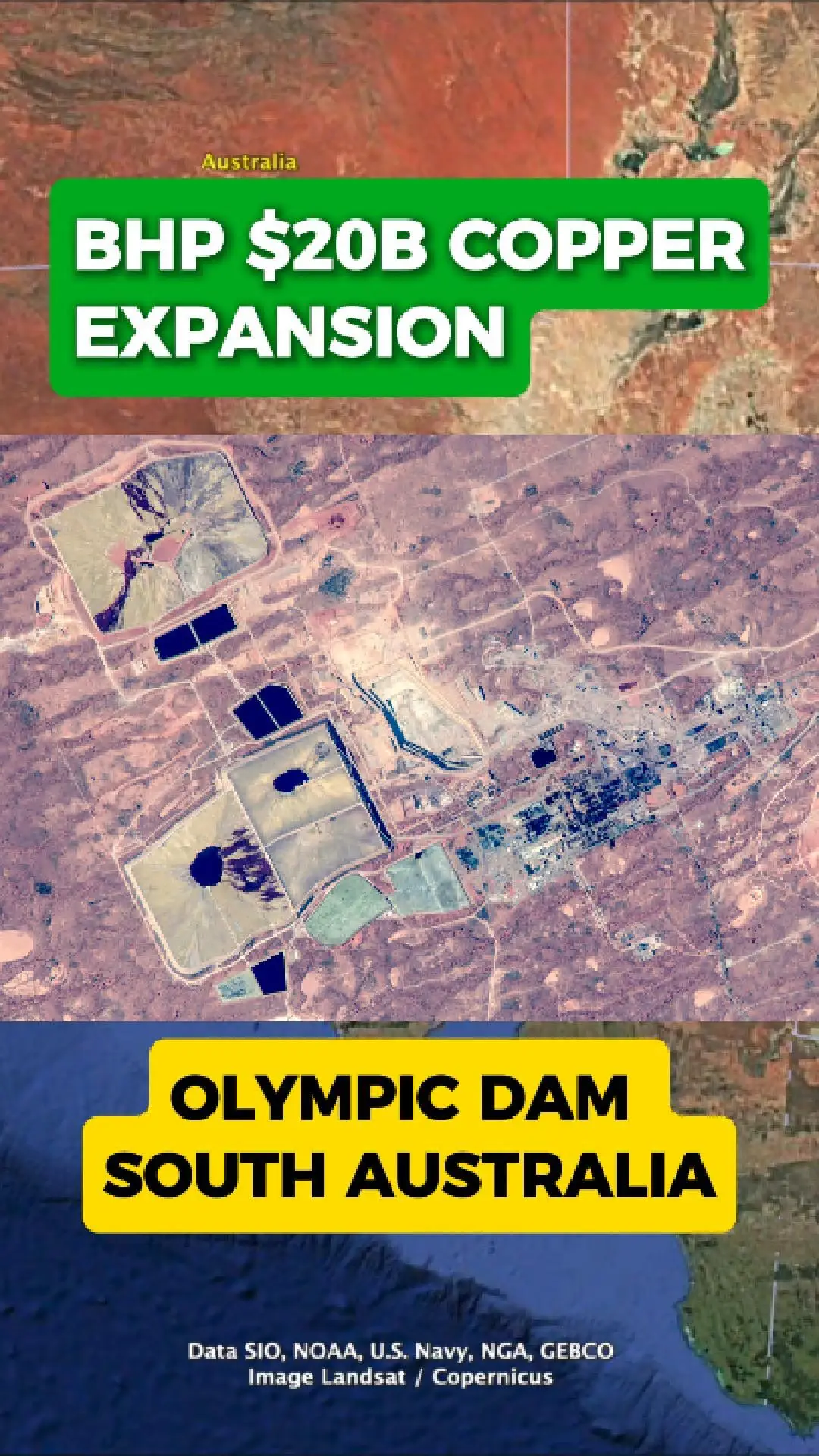

“Because global copper demand is trending up to support electricity networks and AI data centres — and on the supply side Chile’s existing large mines are under pressure with lower ore grades. Estimated up to 50 big discoveries are needed but these will take many years ...

“Because global copper demand is trending up to support electricity networks and AI data centres — and on the supply side Chile’s existing large mines are under pressure with lower ore grades. Estimated up to 50 big discoveries are needed but these will take many years ...