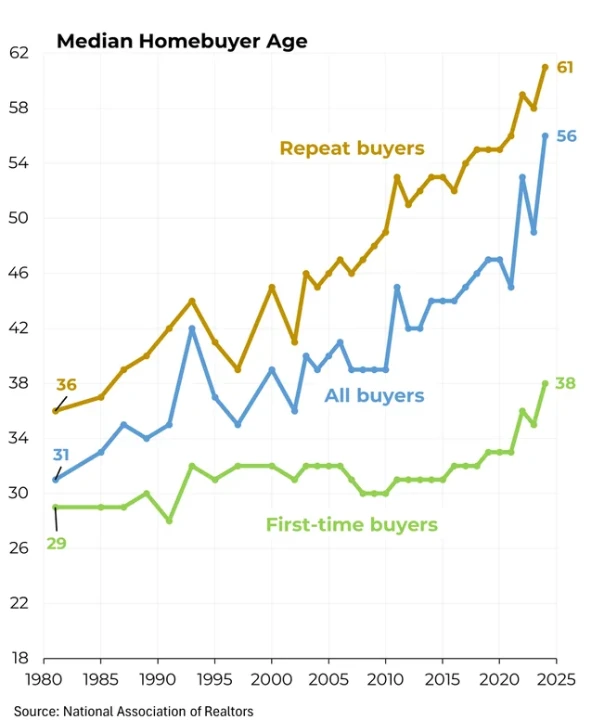

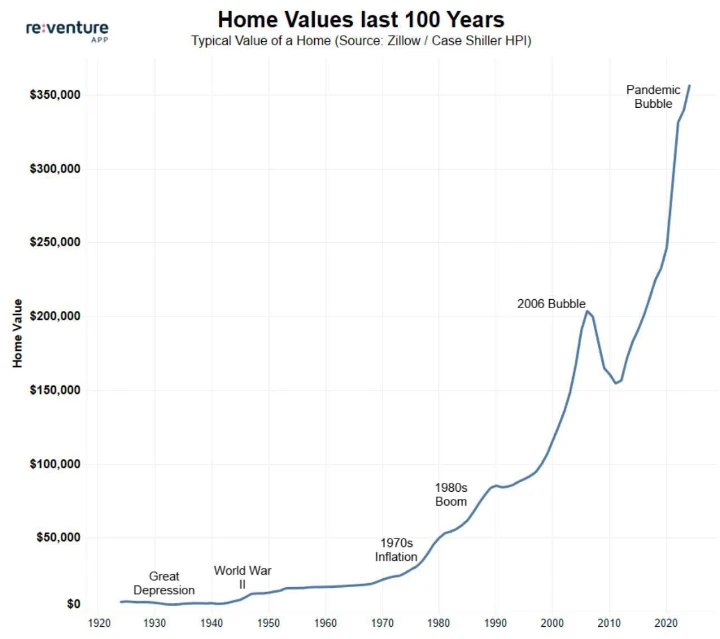

Between 2008 and 2020 surely was the easiest time to bu houses, it's not even close. Not only did prices collapse after the GFC, but interest rates were near zero and super easy to get loans

EXCELSIOR CAPITAL LTD Chat

E Excelsior Capital Ltd

ASX:ECL

Australia

Revenue: 53.5m

$0.0/sec