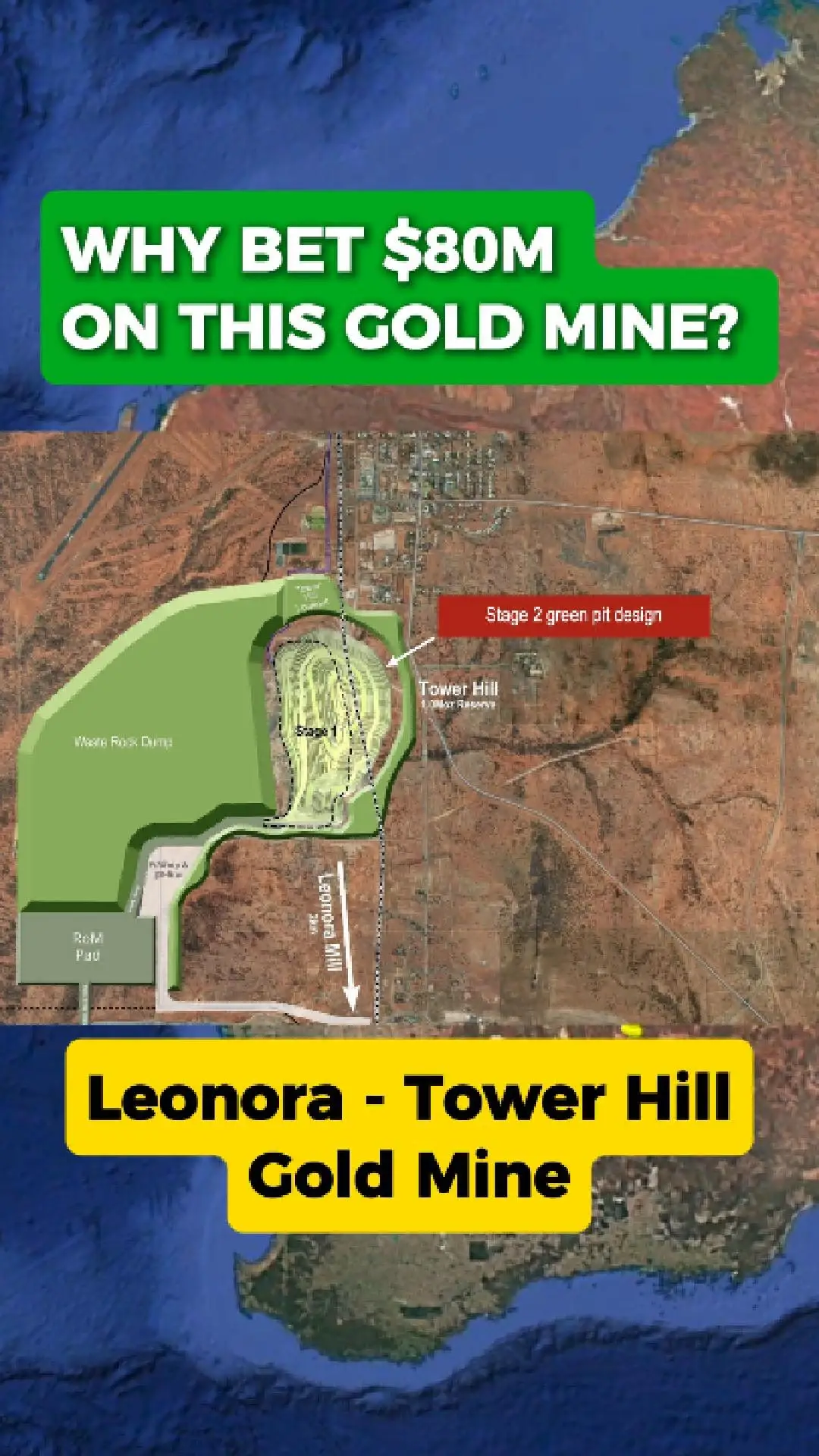

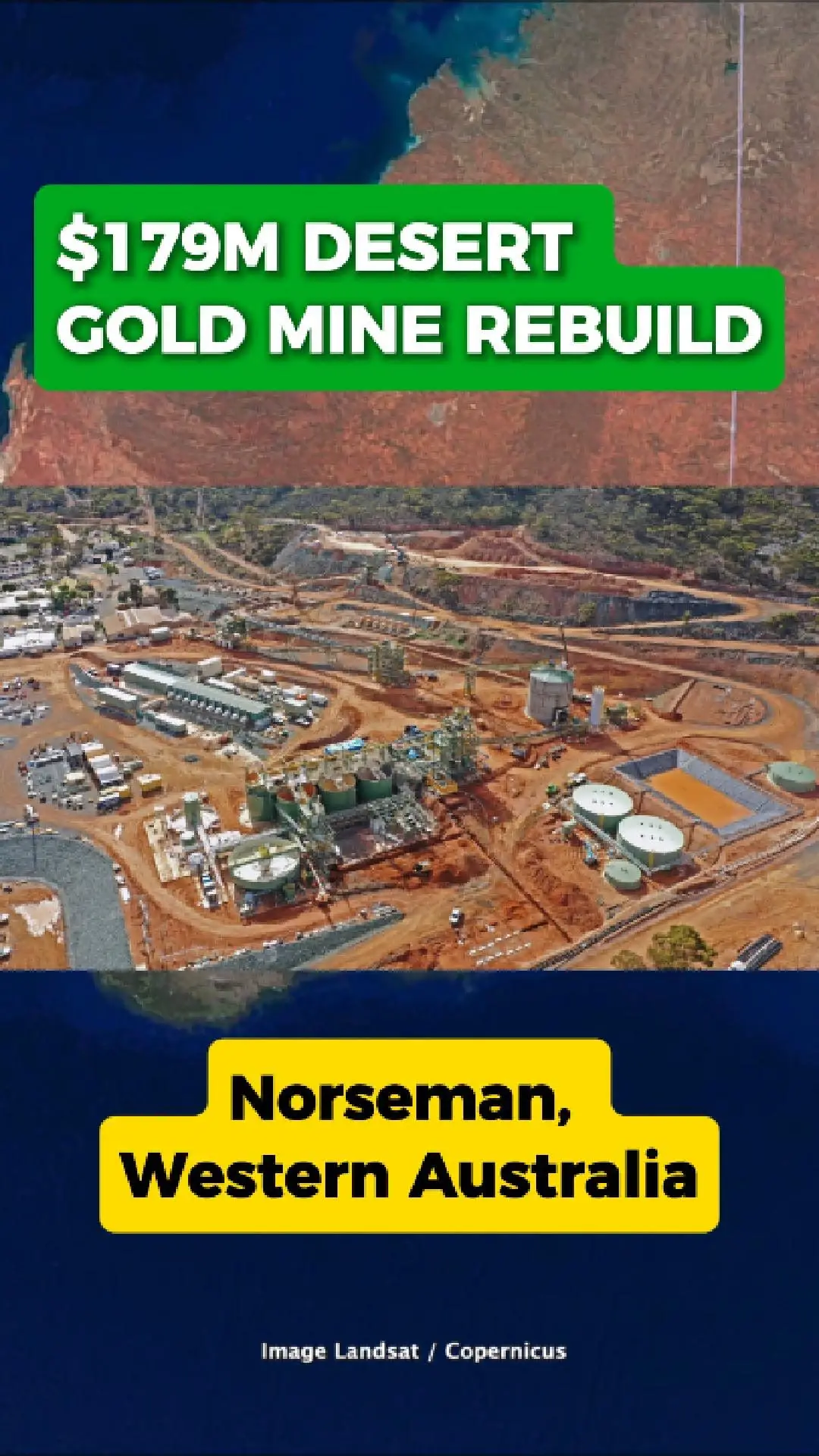

$179m Desert Gold Mine Rebuild At Norseman

Pantoro Is Pushing Ahead With One Of Western Australia’S Biggest Gold Revivals, Investing $179 Million To Restart The Historic Norseman Gold Project In The State’S Remote Desert.

A Major Rebuild In The Wa Outback

The Company Has Overhauled The Entire Operation, Installing A New 1.2-Million-Tonne-Per-Year Processing Plant, Reopening Underground Mines And Bringing Open Pits Back Into Production.

These Upgrades Mark The Most Significant Work At Norseman Since The Operation Was Placed On Care And Maintenance Nearly A Decade Ago.

Nearly One Million Ounces In Reserve

Pantoro Says The Project Now Holds Around 949,000 Ounces In Ore Reserves, With Strong Growth Potential.

Less Than One-Third Of The Known Mineralised Areas Have Been Drilled For Conversion So Far, Leaving A Large Portion Of The Field Still Untapped.

A Historic Goldfield Set For A Comeback

Norseman Has Produced More Than Six Million Ounces Since The 1930s, Making It One Of Australia’S Most Storied Gold Camps.

With New Infrastructure, Modern Equipment And Ongoing Drilling, Pantoro Is Aiming To Return The Site To Significant, Long-Term Production.

Could This Be Norseman’S Next Big Chapter?

With The Rebuild Now Largely Complete And New Ore Sources Coming Online, Pantoro Is Positioning Norseman For A Major Comeback In Western Australia’S Goldfields.

The Next Phase Of Exploration And Development Will Determine Just How Big The Revival Could Become.

ASX:PNR

ASX:PNR