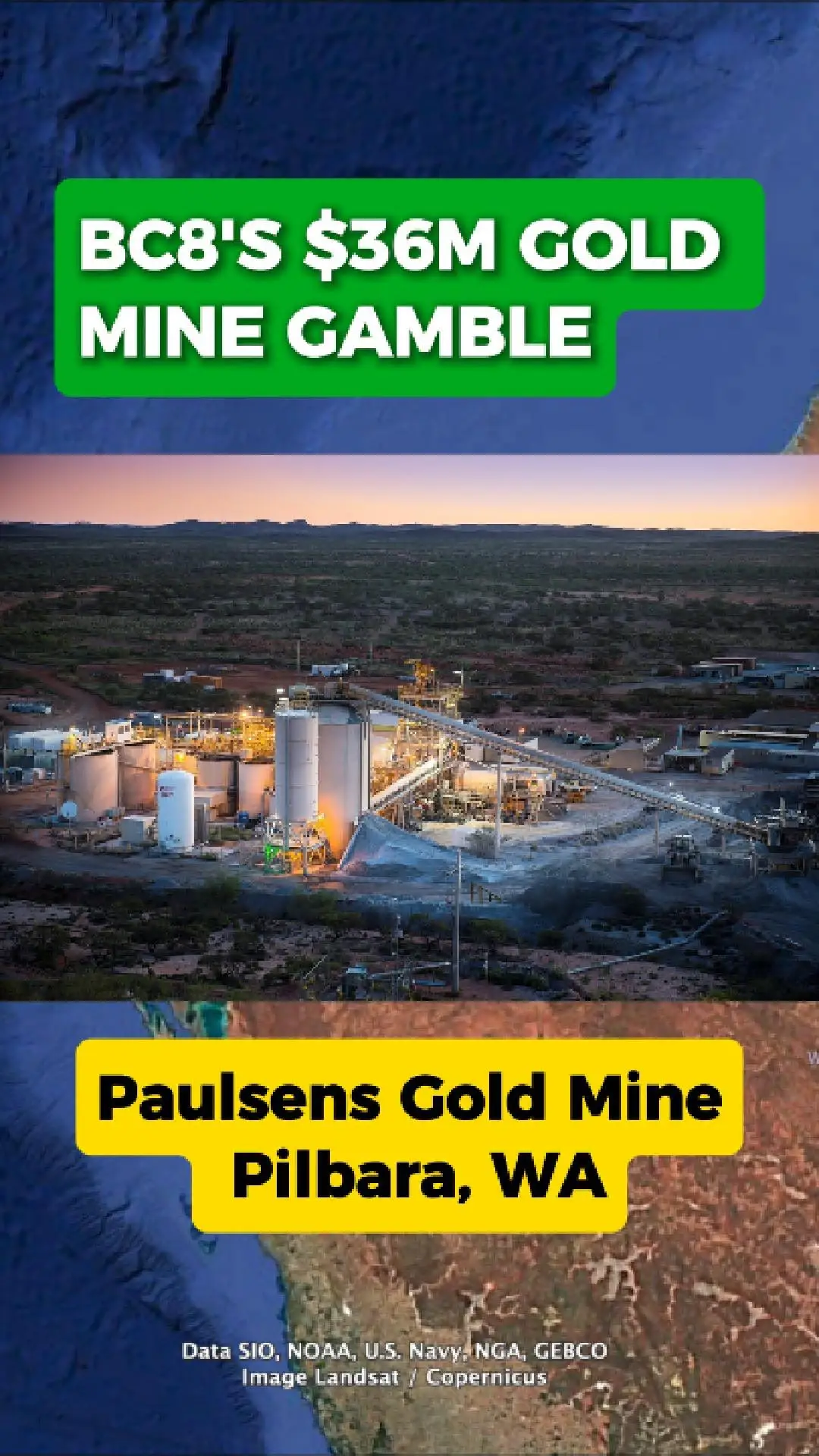

Bc8’S $36m Paulsens Gold Mine Restart: Is The Gamble Paying Off?

Black Cat Syndicate (Asx:Bc8) Committed $36 Million To Restart The Historic Paulsens Gold Mine In Western Australia’S Pilbara Region. The Company’S 2024 Restart Study Pointed To Strong Grades, Improved Mining Plans, And The Potential For A Major Lift In Operating Cashflow.

First Gold Arrives Ahead Of Schedule

By December 2024, Paulsens Had Already Poured Its First Gold Under Black Cat’S Ownership. This Marked A Major Milestone For A Mine That Had Previously Been On Care And Maintenance. Early Production Results Aligned With Expectations And Helped Build Momentum Into 2025.

Drilling Strengthens The Case

Through 2025, Drilling Across The Project Continued To Return Positive Results. New Intercepts Supported Extensions To Known Lodes And Reinforced The Company’S Belief In The Long-Term Potential Of The Paulsens System.

Gold Prices Provide A Tailwind

The Restart Has Come At A Time Of Strong Gold Prices, Giving Black Cat A Favourable Market Backdrop. Higher Margins And Stronger Cashflow Potential Have Helped Make The Restart More Compelling.

New Ground And Ore Deals Add Scale

In Addition To Mine Performance, Black Cat Secured New Exploration Ground And Ore-Supply Agreements With Dreadnought Resources. These Deals Give Paulsens Additional Feed Flexibility And Strengthen The Project’S Growth Pathway.

Is The $36m Gamble Working?

Early Signs Suggest The Restart Is Tracking Well: Gold Poured, Positive Drilling, Growing Production, And Supportive Market Conditions. While It’S Still Early In The Mine’S New Life, The Combination Of Grade, Scale, And Partnerships Indicates The Paulsens Comeback May Only Just Be Beginning.

ASX:BC8

ASX:BC8