R Resolute Mining Limited

ASX:RSG

Australia

Revenue: 801m

$0.0/sec

RESOLUTE MINING LIMITED Chat

Starfish

93d

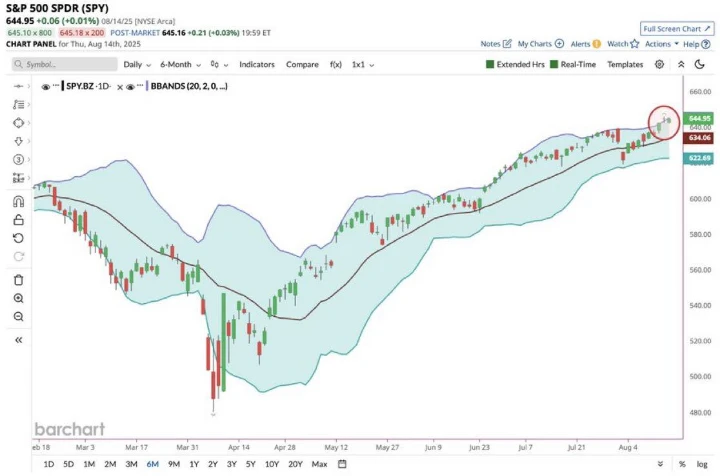

#ASX:TRJ Now looks like a good time to buy with TRJ.