V Vango Mining Limited

ASX:VAN

Australia

918

$AAI

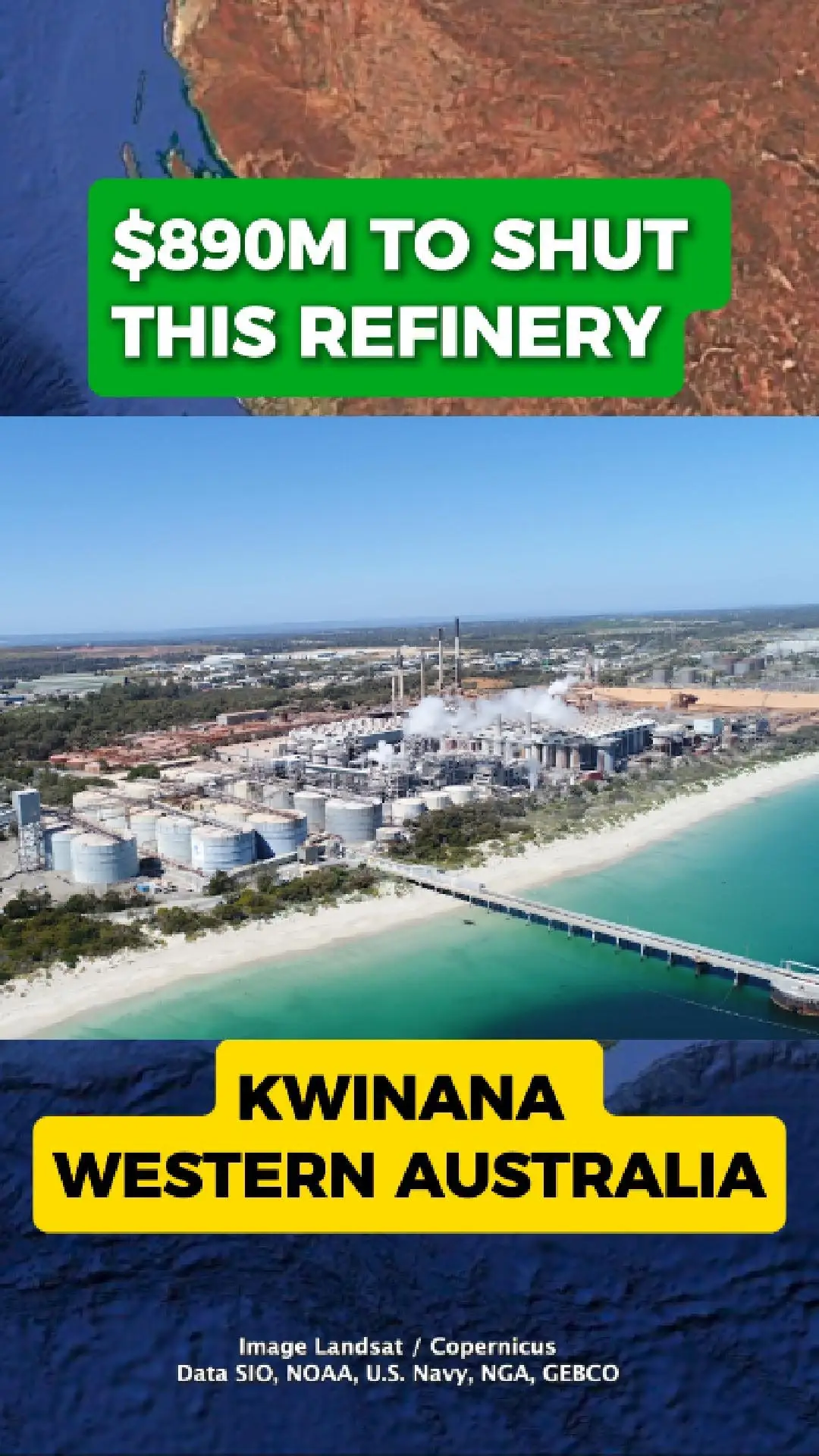

Kwinana Refinery to Close After 60 Years

The Kwinana alumina refinery in Western Australia is closing permanently after more than six decades of operation. The facility has been a major part of the local industrial landscape since the 1960s.

Why It’s Closing

Alcoa says the refinery is too old, too expensive to run, ...

The Kwinana alumina refinery in Western Australia is closing permanently after more than six decades of operation. The facility has been a major part of the local industrial landscape since the 1960s.

Why It’s Closing

Alcoa says the refinery is too old, too expensive to run, ...

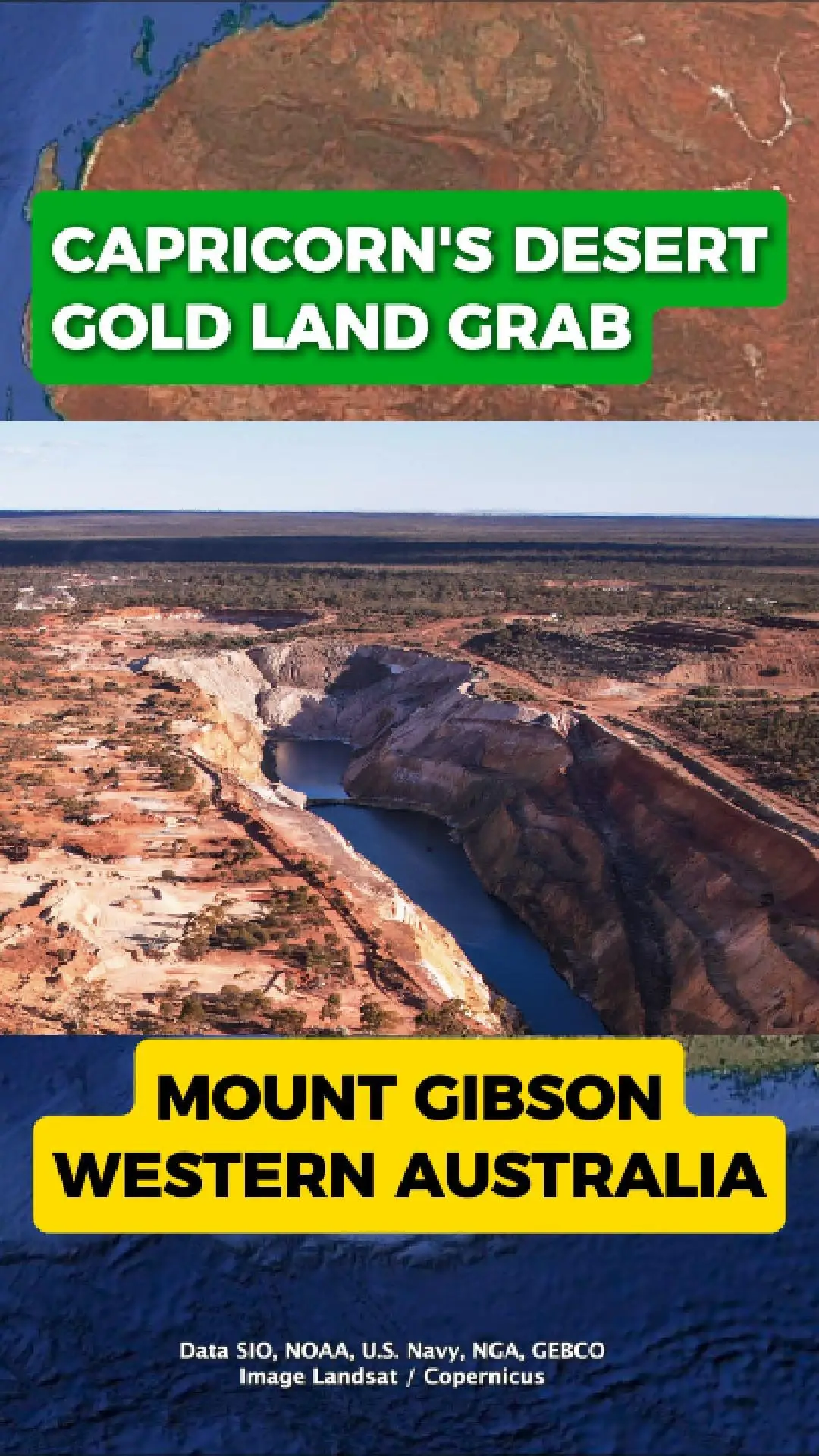

$CMM

Capricorn Expands in Mount Gibson Gold District

Capricorn Metals has made a low-key Christmas acquisition in Western Australia’s Mount Gibson gold district, strengthening its regional footprint.

The company has agreed to buy the nearby Yalgoo project for $4.5 million, adding around 1,000 square kilometres of prospective ground to its existing exploration holdings.

Strengthening ...

Capricorn Metals has made a low-key Christmas acquisition in Western Australia’s Mount Gibson gold district, strengthening its regional footprint.

The company has agreed to buy the nearby Yalgoo project for $4.5 million, adding around 1,000 square kilometres of prospective ground to its existing exploration holdings.

Strengthening ...

$OBM

Davyhurst Gold Mine Ramps Up After Turnaround

The Davyhurst Gold Mine in Western Australia was once seen as a challenged operation. After a period of underperformance, the mine has now returned to growth following a major operational reset.

Operations Back on Track

Ora Banda Mining cleaned up its mining and processing operations, improving ...

The Davyhurst Gold Mine in Western Australia was once seen as a challenged operation. After a period of underperformance, the mine has now returned to growth following a major operational reset.

Operations Back on Track

Ora Banda Mining cleaned up its mining and processing operations, improving ...

$POL

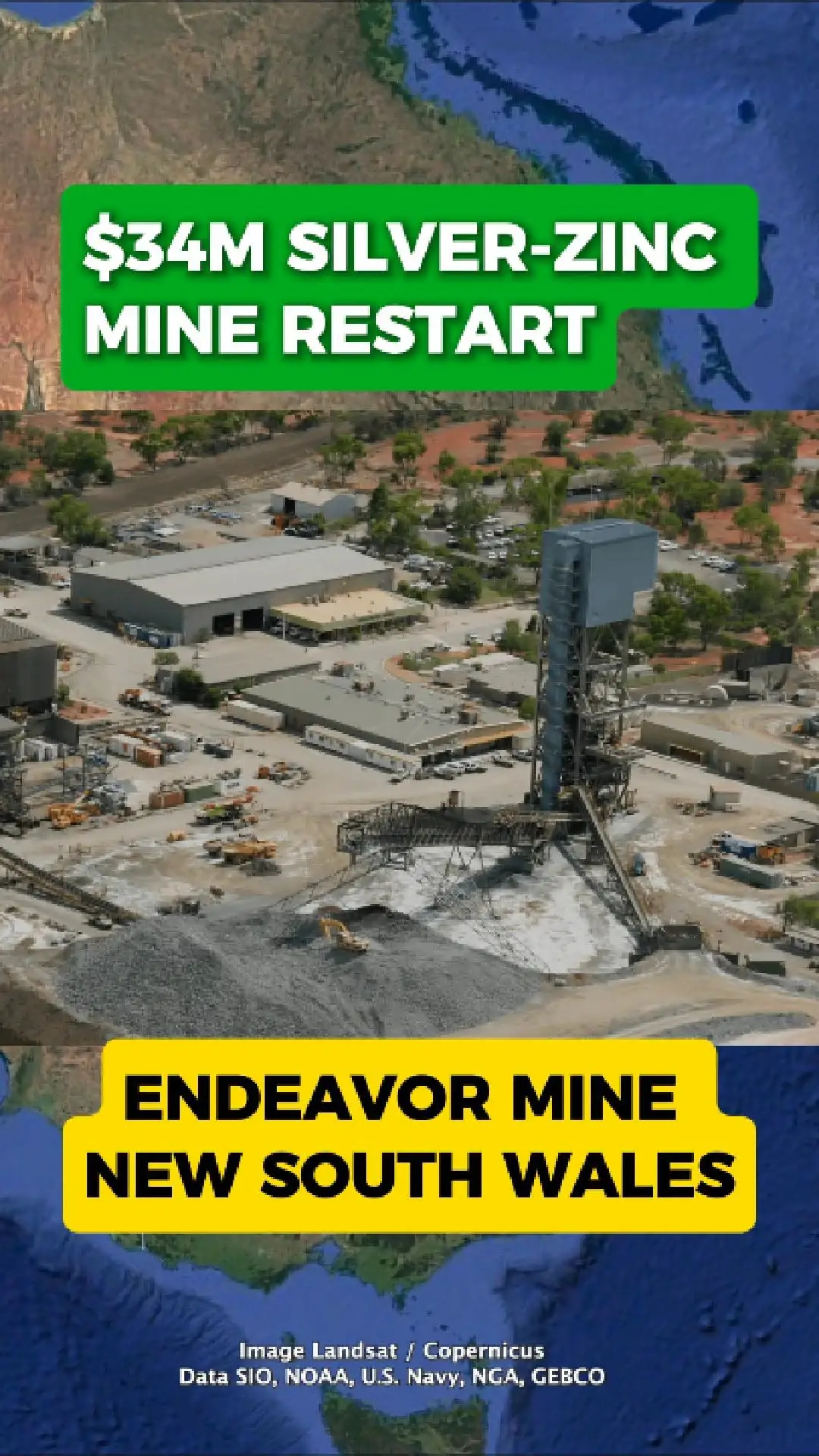

Polymetals Raises Funds to Ramp Up Endeavor Mine

The Endeavor mine in outback New South Wales is ramping back into production after a period of inactivity. The historic silver-zinc operation has recently restarted, with mining activity building as the site returns to steady operations.

$34 Million Capital Raise

Polymetals Resources has raised more ...

The Endeavor mine in outback New South Wales is ramping back into production after a period of inactivity. The historic silver-zinc operation has recently restarted, with mining activity building as the site returns to steady operations.

$34 Million Capital Raise

Polymetals Resources has raised more ...

$GG8

Comet Vale Gold Project Scales Up in Western Australia

The Comet Vale gold project in Western Australia, once a quiet and largely forgotten mine, is back in focus as drilling activity ramps up across the site. What was previously a small resource has now grown significantly following a year of sustained ...

The Comet Vale gold project in Western Australia, once a quiet and largely forgotten mine, is back in focus as drilling activity ramps up across the site. What was previously a small resource has now grown significantly following a year of sustained ...

$WC8

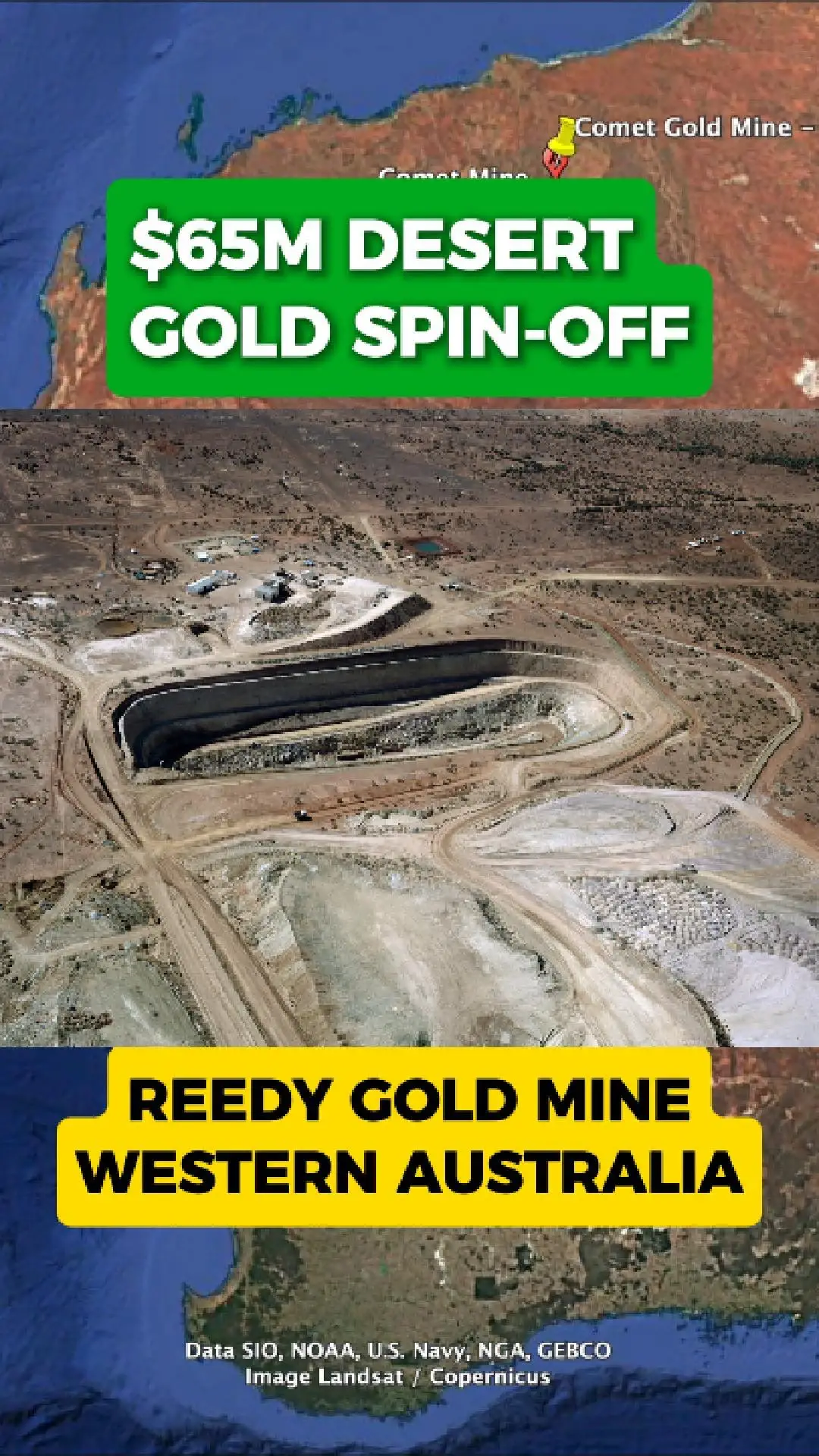

Reedy Gold Mine Set for New Chapter

The old Reedy Gold Mine in Western Australia is set to get a second chance, following a major corporate restructure by Westgold Resources.

Westgold has announced plans to spin out the Reedy project, along with the nearby Comet project, into a new ASX-listed company called ...

The old Reedy Gold Mine in Western Australia is set to get a second chance, following a major corporate restructure by Westgold Resources.

Westgold has announced plans to spin out the Reedy project, along with the nearby Comet project, into a new ASX-listed company called ...

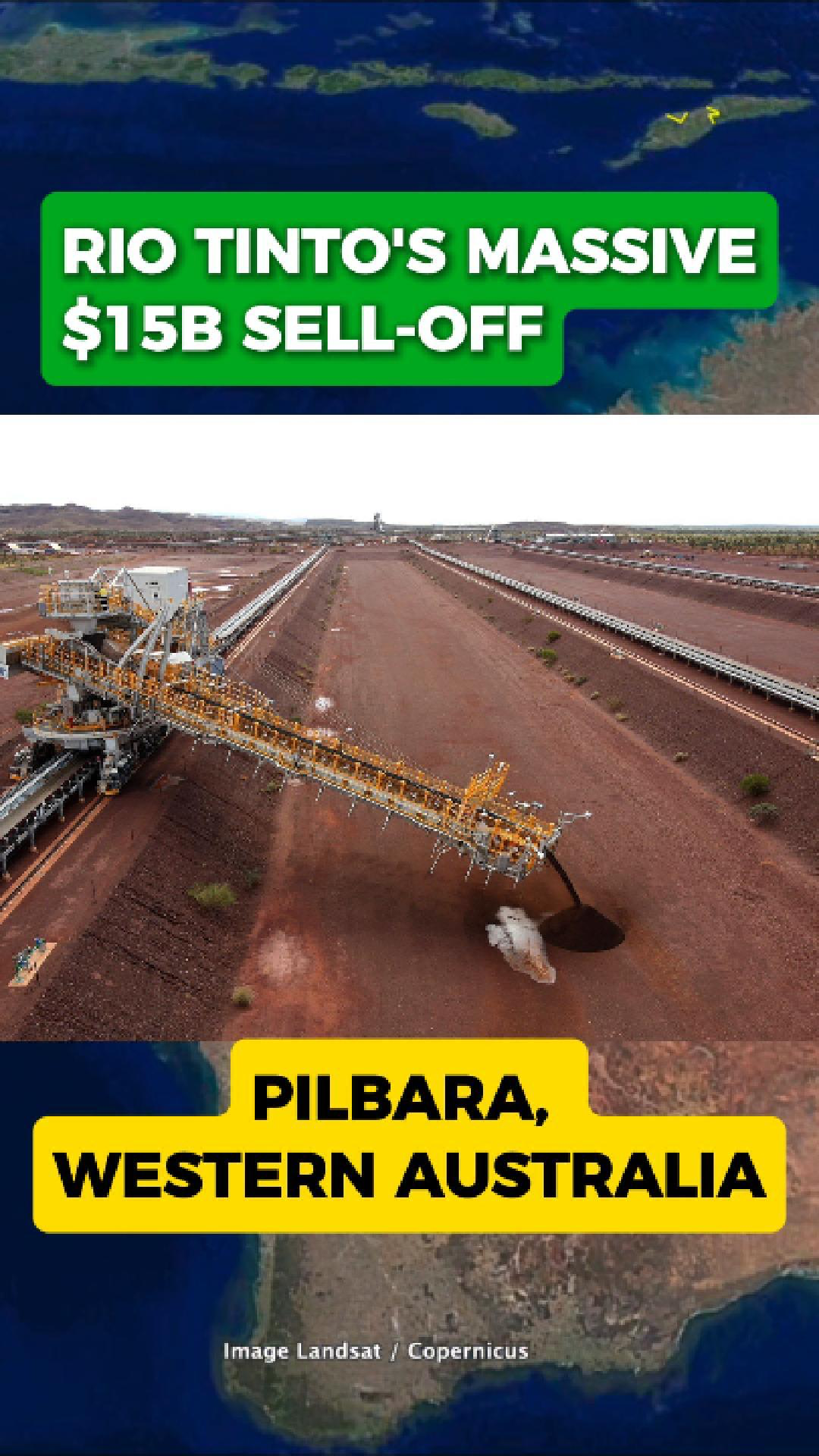

$MIN

MinRes Expands Onslow Iron With $3.5B Build

Ken’s Bore mine near Onslow was once empty red desert. Today, it sits at the centre of one of Australia’s largest new iron-ore developments, as Mineral Resources continues to scale up its Onslow Iron project in Western Australia.

New Mines, Port and Haul Road

MinRes is ...

Ken’s Bore mine near Onslow was once empty red desert. Today, it sits at the centre of one of Australia’s largest new iron-ore developments, as Mineral Resources continues to scale up its Onslow Iron project in Western Australia.

New Mines, Port and Haul Road

MinRes is ...

$BHP

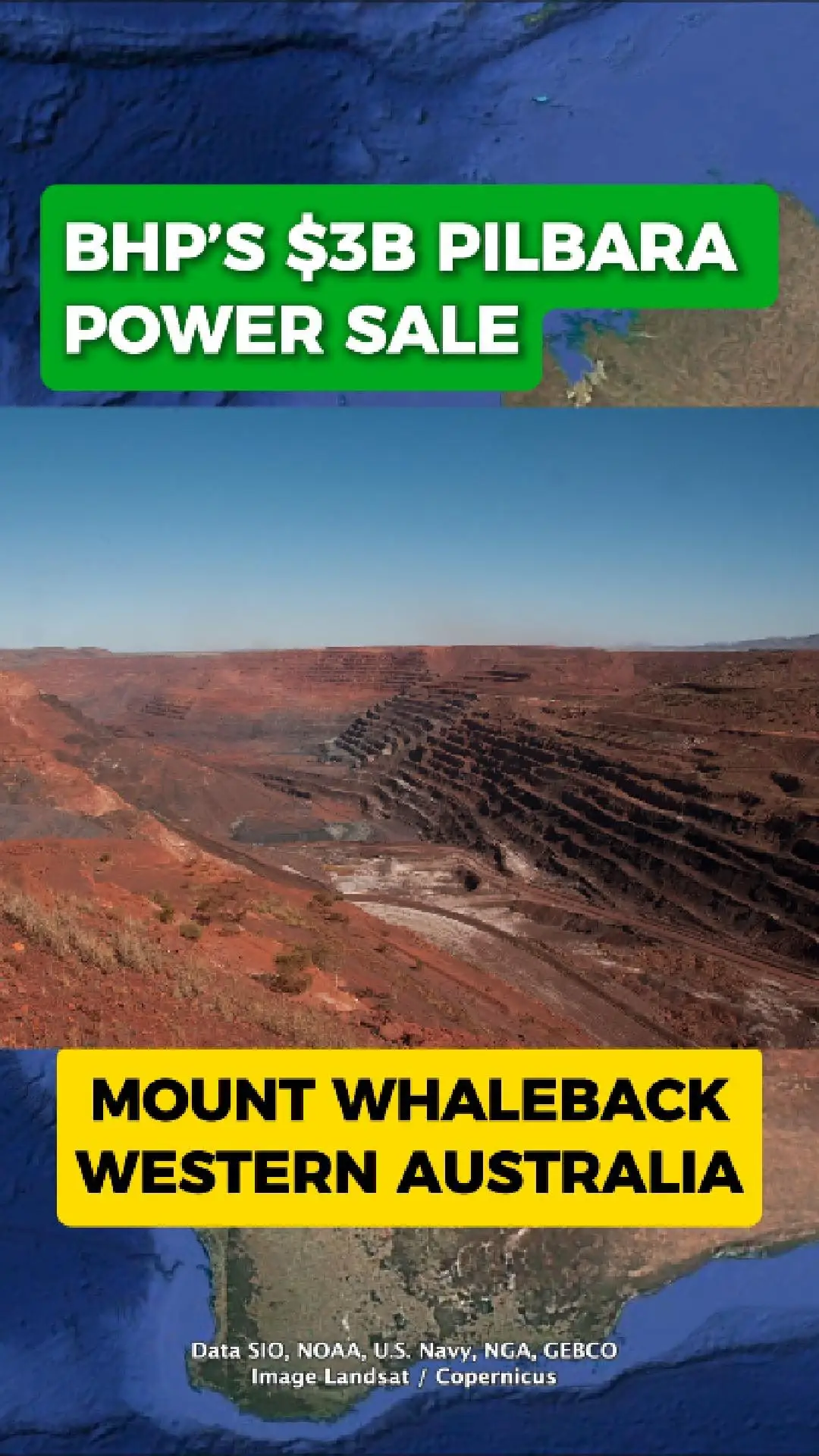

BHP Sells $3B Stake in Pilbara Power Network

Mount Whaleback — one of the world’s largest open-cut iron-ore mines — depends on a vast inland power network that keeps crushers, haul roads and remote camps running across the Pilbara.

This network supplies electricity not only to Mount Whaleback, but to BHP’s broader ...

Mount Whaleback — one of the world’s largest open-cut iron-ore mines — depends on a vast inland power network that keeps crushers, haul roads and remote camps running across the Pilbara.

This network supplies electricity not only to Mount Whaleback, but to BHP’s broader ...

$FEX

Fenix Shifts Iron Ore Focus to Weld Range

Every year, millions of tonnes of iron ore leave Western Australia’s red desert, feeding global steel markets. Now Fenix Resources is repositioning its iron ore operations, placing the Weld Range at the centre of its future production plans.

As the company’s earlier pits begin ...

Every year, millions of tonnes of iron ore leave Western Australia’s red desert, feeding global steel markets. Now Fenix Resources is repositioning its iron ore operations, placing the Weld Range at the centre of its future production plans.

As the company’s earlier pits begin ...

$WC8

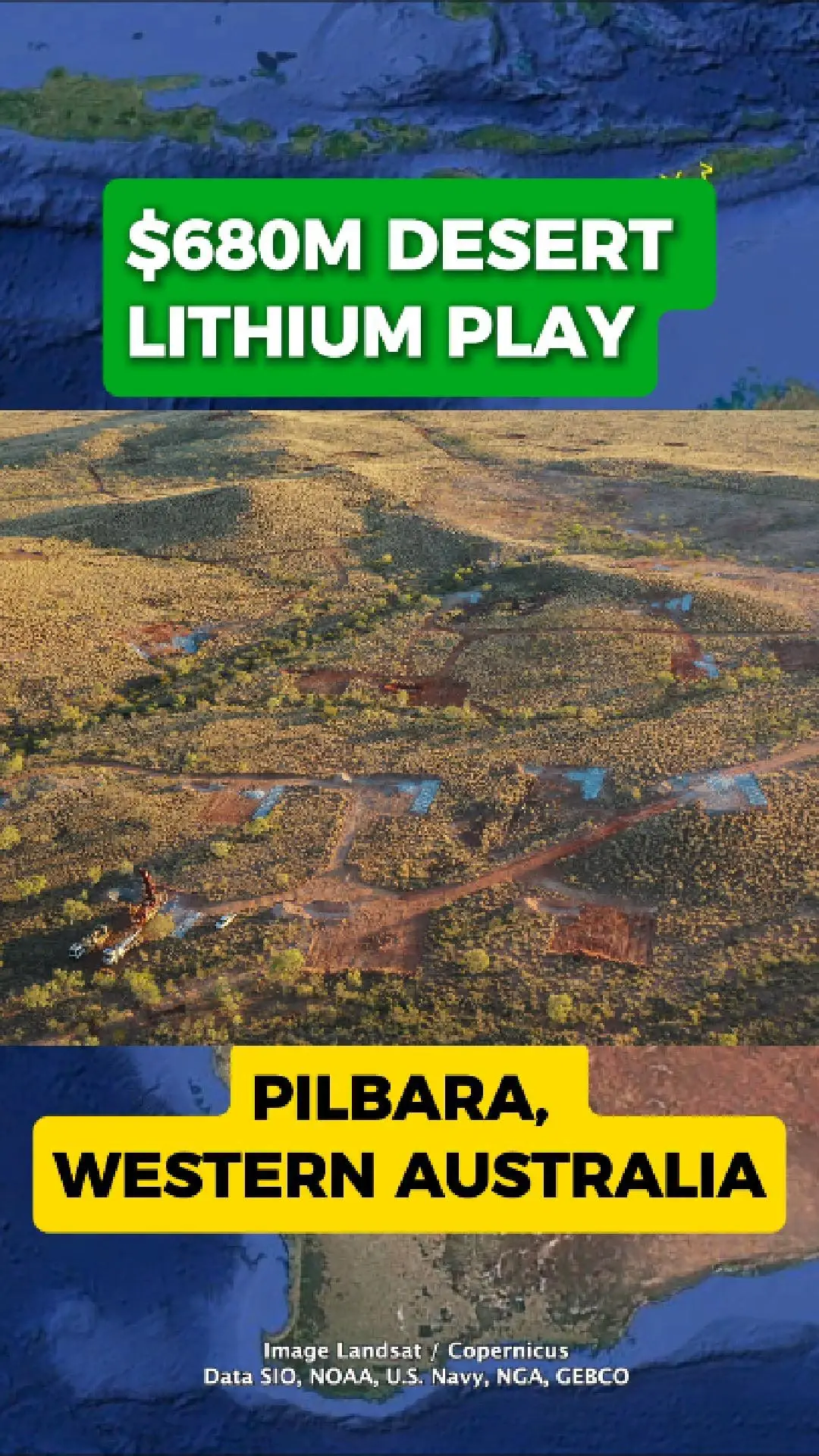

$680m Pilbara Lithium Push Takes Shape at Tabba Tabba

Just outside Port Hedland, in the heart of Western Australia’s Pilbara, Wildcat Resources is advancing its Tabba Tabba lithium play — a rapidly progressing project positioned in one of the world’s most active battery-minerals regions.

The project sits roughly 80 kilometres from port ...

Just outside Port Hedland, in the heart of Western Australia’s Pilbara, Wildcat Resources is advancing its Tabba Tabba lithium play — a rapidly progressing project positioned in one of the world’s most active battery-minerals regions.

The project sits roughly 80 kilometres from port ...

$IMA

Why $50 million is being spent restarting a WA zircon mine

Image Resources has invested more than $50 million to bring its Atlas mineral sands project back into full production, around 180 kilometres north of Perth in Western Australia.

The Atlas project replaces the company’s earlier Boonanarring operation and began production in ...

Image Resources has invested more than $50 million to bring its Atlas mineral sands project back into full production, around 180 kilometres north of Perth in Western Australia.

The Atlas project replaces the company’s earlier Boonanarring operation and began production in ...

$HAS

Why Spend Over $400M Building This WA Rare-Earth Mine?

Around 1,000 kilometres north of Perth, the Yangibana rare-earths project is aiming to become one of Australia’s key suppliers of neodymium and praseodymium (NdPr) — metals used in electric-vehicle motors, wind turbines and defence technology. The site sits in the Gascoyne region, ...

Around 1,000 kilometres north of Perth, the Yangibana rare-earths project is aiming to become one of Australia’s key suppliers of neodymium and praseodymium (NdPr) — metals used in electric-vehicle motors, wind turbines and defence technology. The site sits in the Gascoyne region, ...

Popular Stocks 🚀

Show more