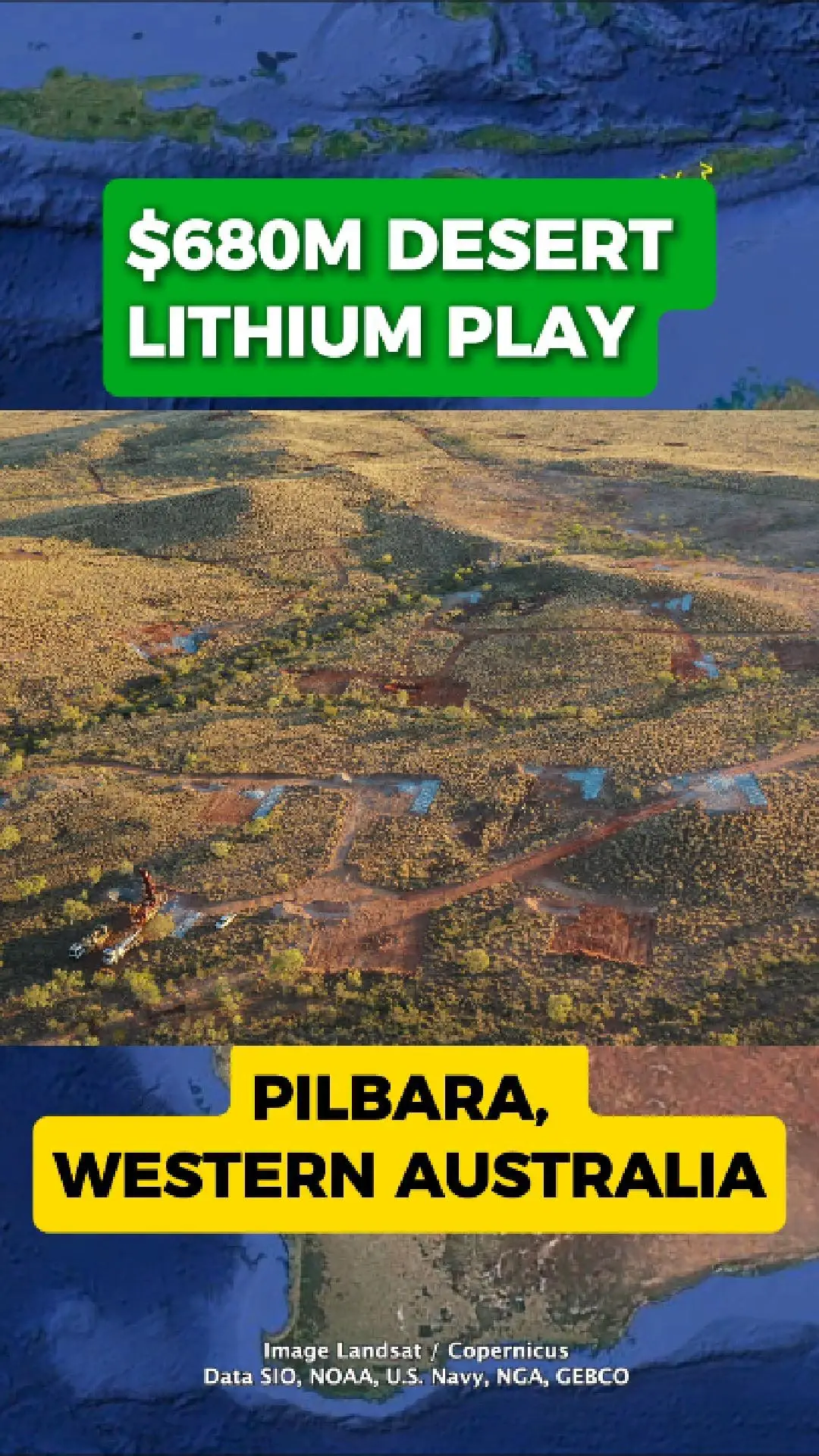

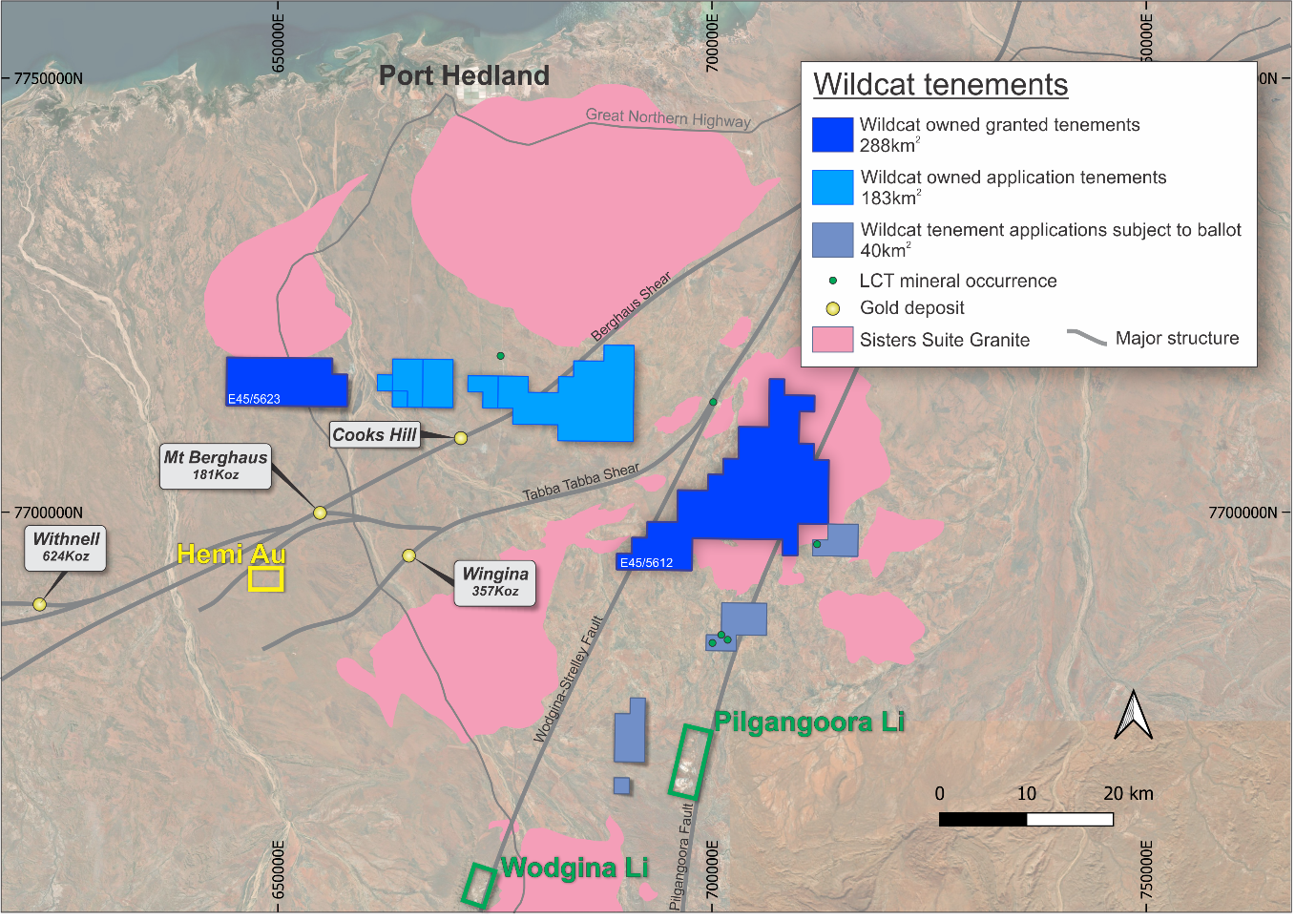

$680m Pilbara Lithium Push Takes Shape At Tabba Tabba

Just Outside Port Hedland, In The Heart Of Western Australia’S Pilbara, Wildcat Resources Is Advancing Its Tabba Tabba Lithium Play — A Rapidly Progressing Project Positioned In One Of The World’S Most Active Battery-Minerals Regions.

The Project Sits Roughly 80 Kilometres From Port Infrastructure, Giving It A Logistical Advantage As Lithium Demand Stabilises.

Pfs Outlines $443m Stage 1 Build

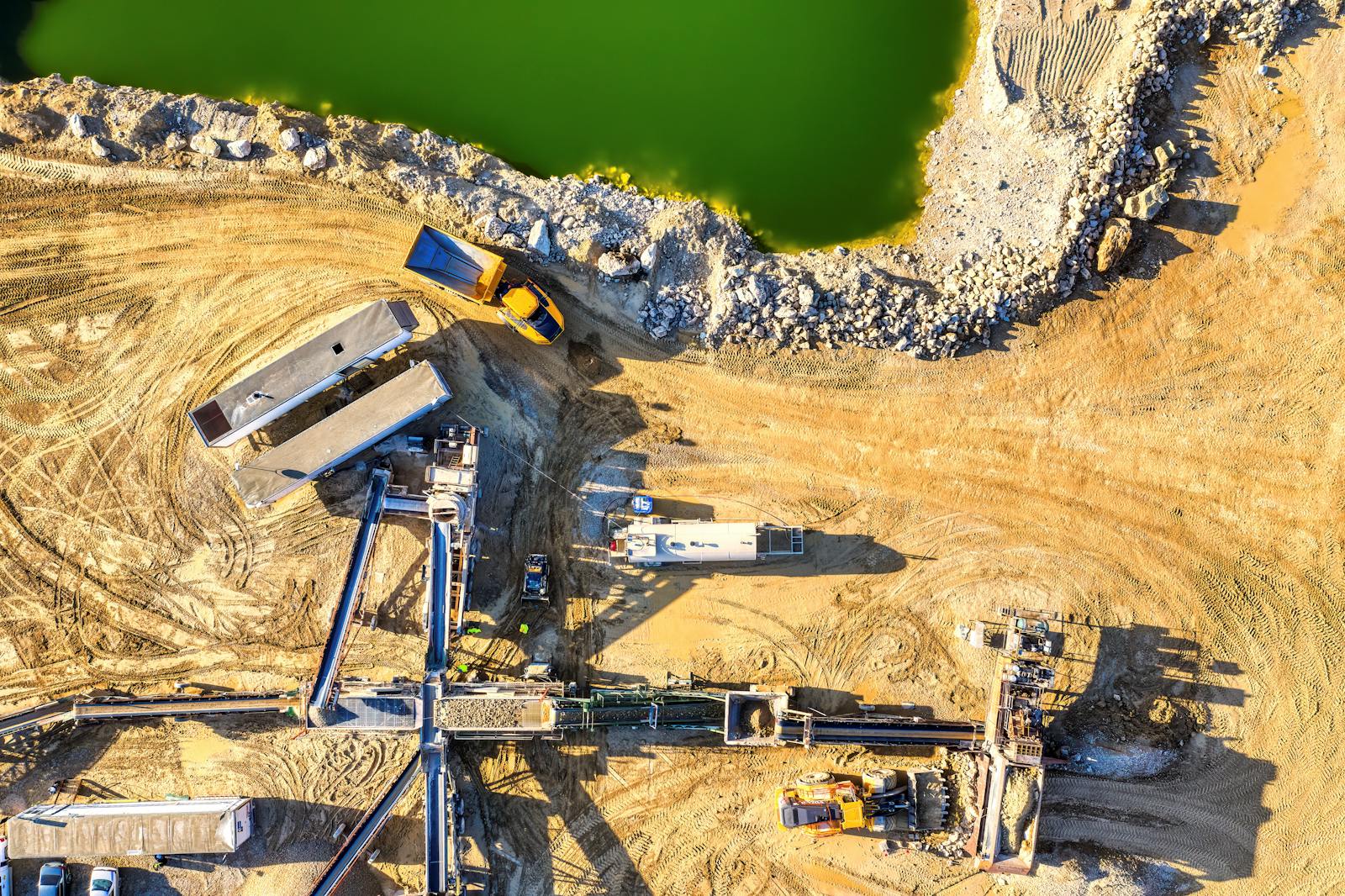

A Recently Completed Pre-Feasibility Study Outlines An Estimated $443 Million Capital Cost For Stage 1 Development, Including Processing Infrastructure Designed To Extract Spodumene Concentrate From Large Pegmatite Bodies On Site.

This Is Complemented By $144 Million In Pre-Strip Mining, Required To Expose The Initial Ore Zones And Prepare The Pit For Early Production.

These Figures Combine For A Total Pre-Production Estimate Of Around $680 Million, Positioning Tabba Tabba As One Of The More Advanced Lithium Developments In The Pilbara.

Why The Project Matters

Wildcat Resources Has Been Pushing The Project Forward With Aggressive Drilling, Resource Expansion, And Technical Studies.

With Mining Leases Granted And Development Studies Underway, Tabba Tabba Is Emerging As A Notable Contender In Western Australia’S Next Wave Of Lithium Supply.

Could It Become A Standout Wa Lithium Mine?

Much Will Depend On Lithium Pricing, Global Supply Dynamics, And The Project’S Final Feasibility Outcomes.

But With Strong Infrastructure Links, A Large-Scale Development Plan, And A Significant Pre-Production Budget, Tabba Tabba Is Firmly On The Radar As One Of Western Australia’S Most Advanced Lithium Projects.

ASX:WC8

ASX:WC8