$WC8

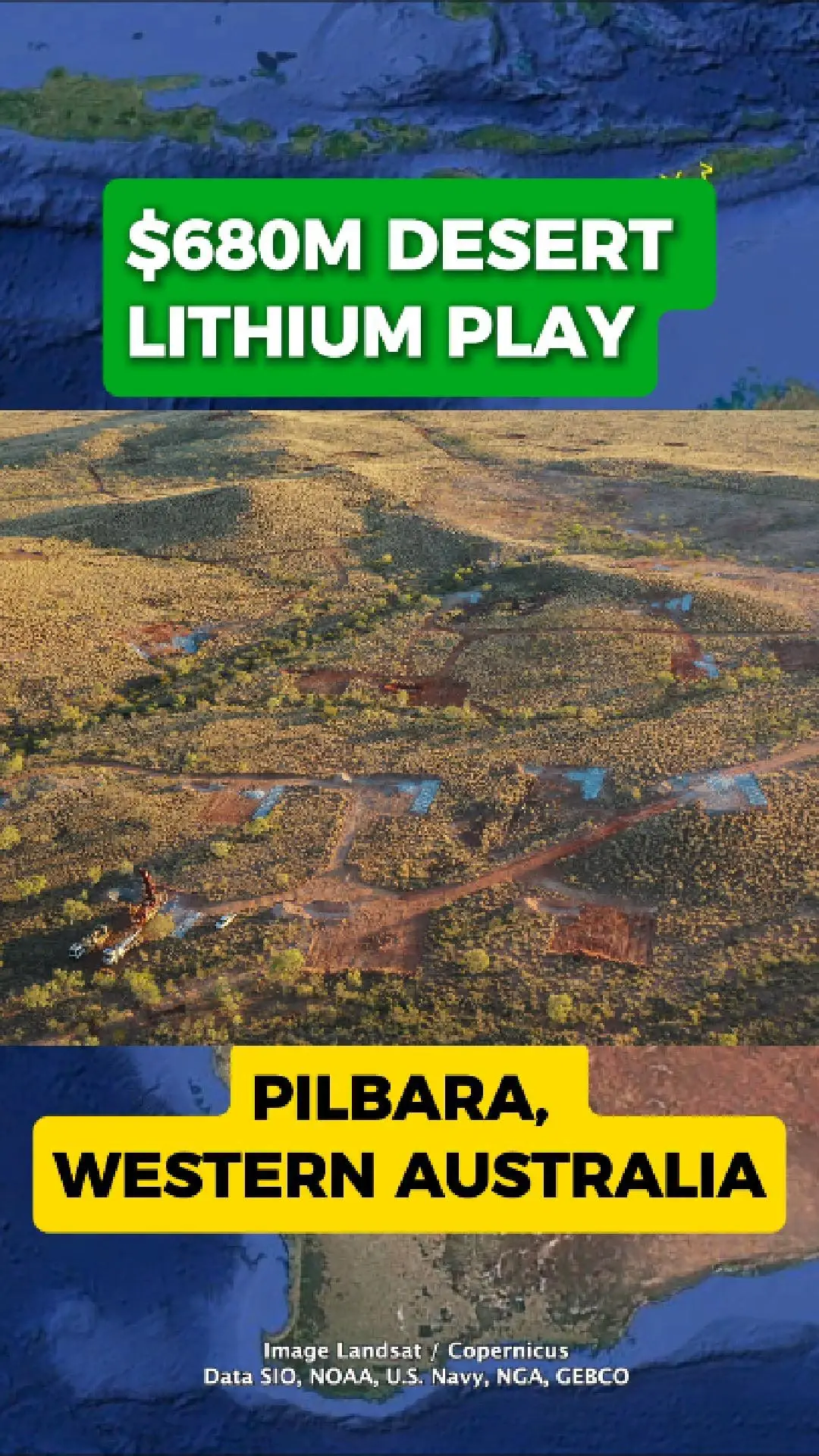

$680m Pilbara Lithium Push Takes Shape at Tabba Tabba

Just outside Port Hedland, in the heart of Western Australia’s Pilbara, Wildcat Resources is advancing its Tabba Tabba lithium play — a rapidly progressing project positioned in one of the world’s most active battery-minerals regions.

The project sits roughly 80 kilometres from port ...

Just outside Port Hedland, in the heart of Western Australia’s Pilbara, Wildcat Resources is advancing its Tabba Tabba lithium play — a rapidly progressing project positioned in one of the world’s most active battery-minerals regions.

The project sits roughly 80 kilometres from port ...