$BHP

BHP Sells $3B Stake in Pilbara Power Network

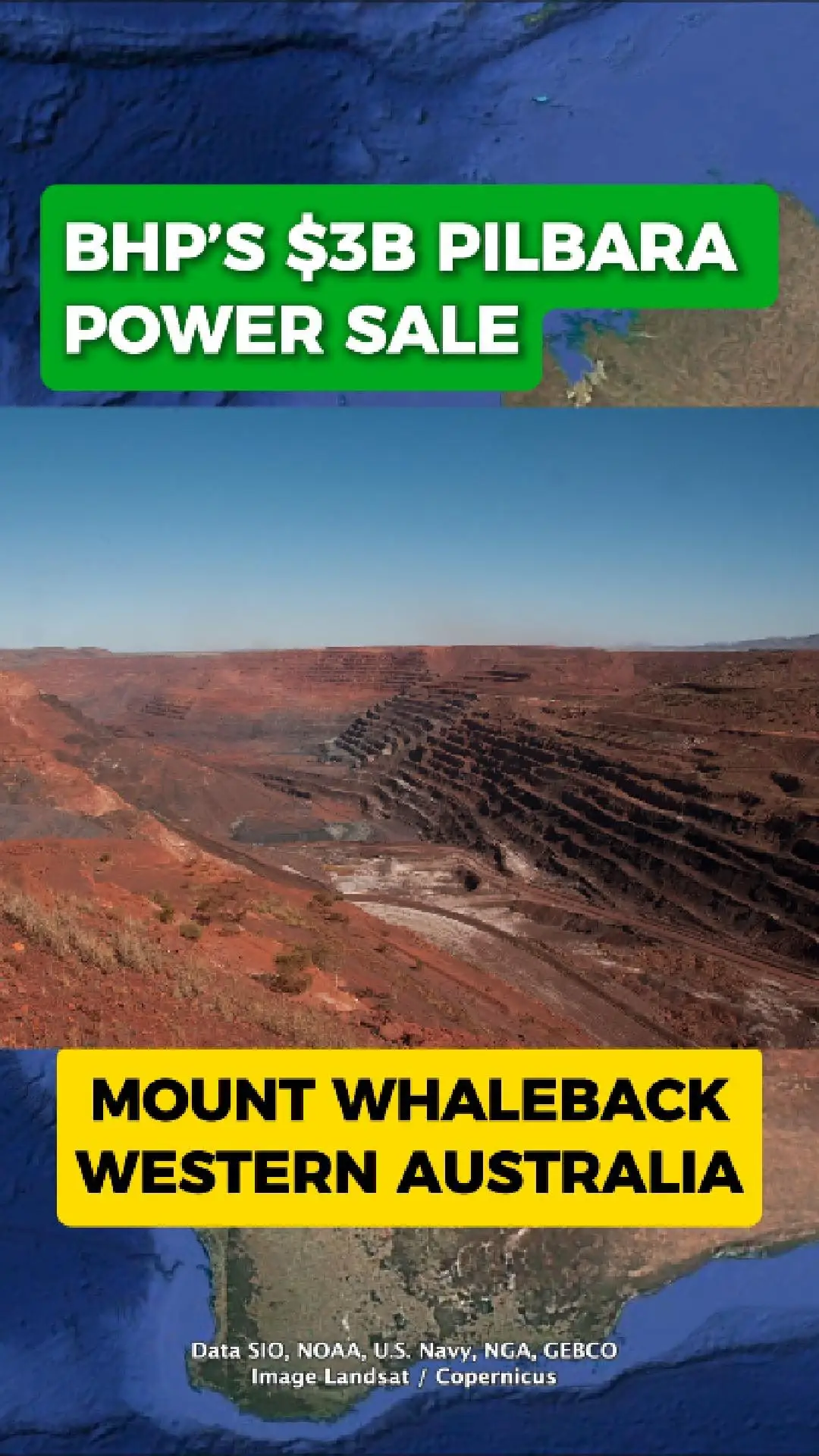

Mount Whaleback — one of the world’s largest open-cut iron-ore mines — depends on a vast inland power network that keeps crushers, haul roads and remote camps running across the Pilbara.

This network supplies electricity not only to Mount Whaleback, but to BHP’s broader ...

Mount Whaleback — one of the world’s largest open-cut iron-ore mines — depends on a vast inland power network that keeps crushers, haul roads and remote camps running across the Pilbara.

This network supplies electricity not only to Mount Whaleback, but to BHP’s broader ...