$WC8

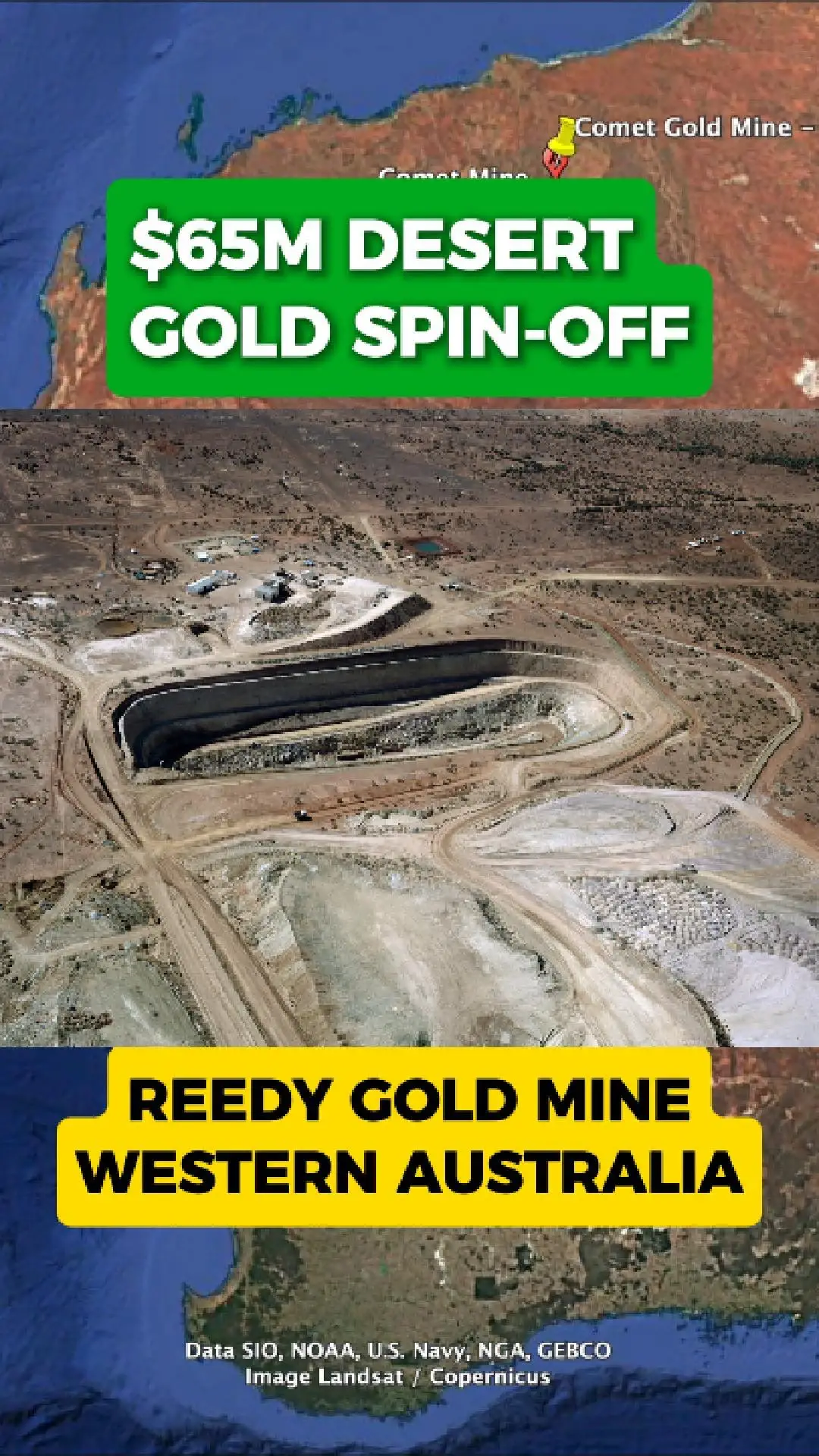

Reedy Gold Mine Set for New Chapter

The old Reedy Gold Mine in Western Australia is set to get a second chance, following a major corporate restructure by Westgold Resources.

Westgold has announced plans to spin out the Reedy project, along with the nearby Comet project, into a new ASX-listed company called ...

The old Reedy Gold Mine in Western Australia is set to get a second chance, following a major corporate restructure by Westgold Resources.

Westgold has announced plans to spin out the Reedy project, along with the nearby Comet project, into a new ASX-listed company called ...