$RIO

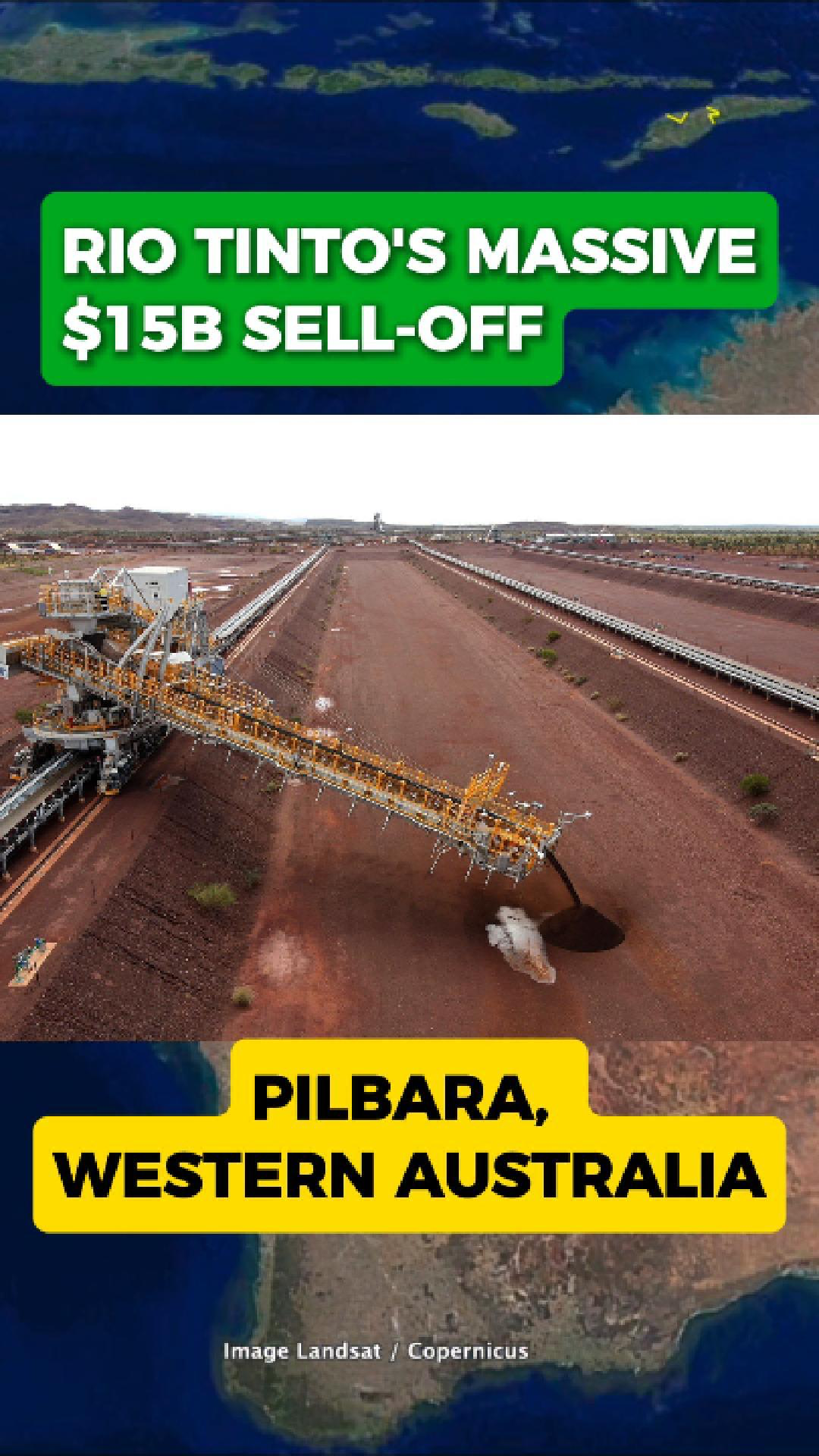

Rio Tinto Launches $15 Billion Asset Sell-Off

Rio Tinto has announced plans to sell up to $15 billion worth of assets as part of a strategy to streamline the company and refocus on its core operations. The move marks one of the largest portfolio resets in the miner’s history.

Iron Ore Still ...

Rio Tinto has announced plans to sell up to $15 billion worth of assets as part of a strategy to streamline the company and refocus on its core operations. The move marks one of the largest portfolio resets in the miner’s history.

Iron Ore Still ...