$VAU

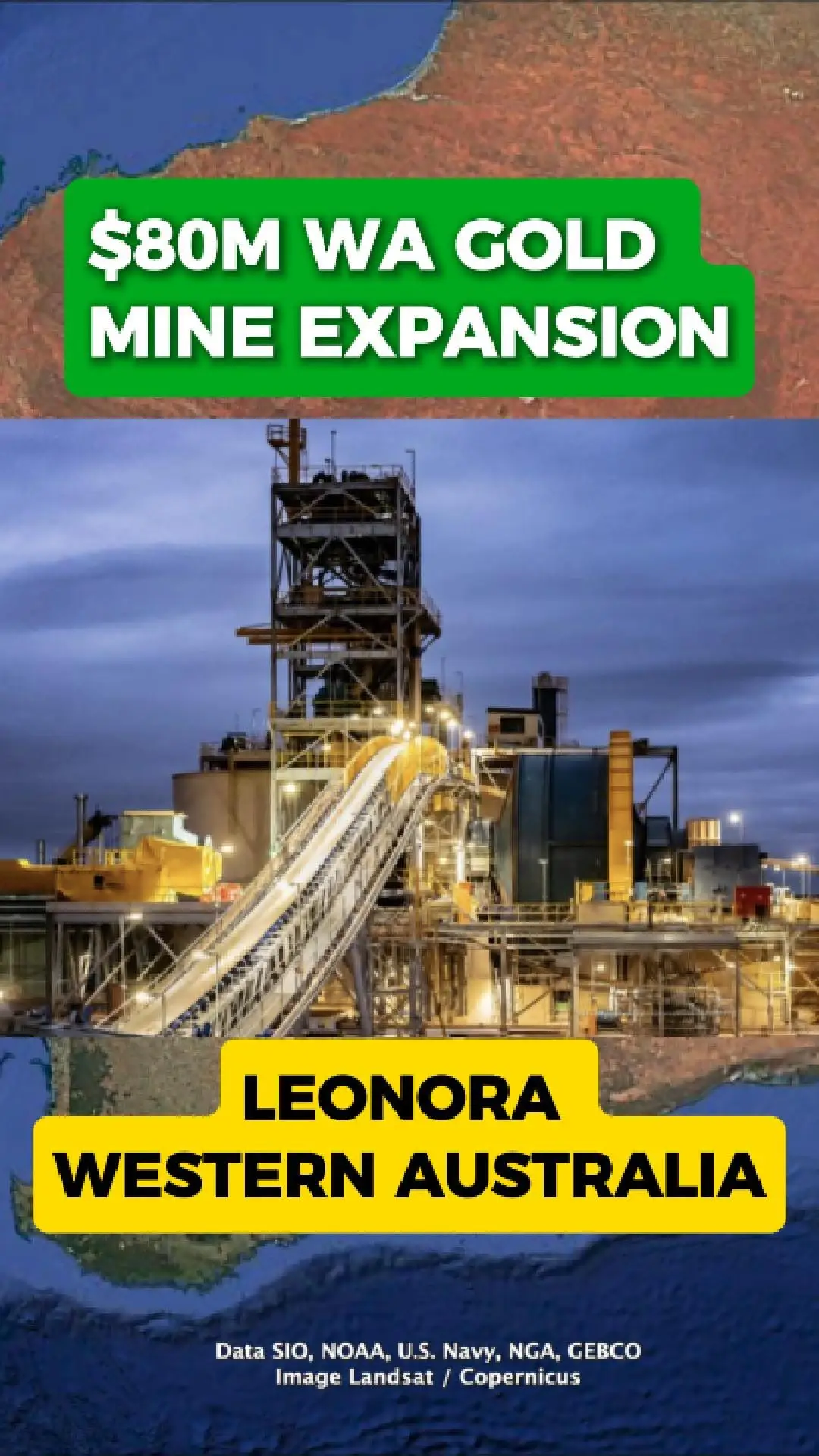

Vault Minerals Approves $80M Expansion at King of the Hills

Vault Minerals (ASX: VAU) has signed off on an $80 million expansion of its King of the Hills (KOTH) gold operation near Leonora, aiming to lift processing capacity and unlock more of the district’s long-life potential.

New Crusher and Mill Upgrades:

The project ...

Vault Minerals (ASX: VAU) has signed off on an $80 million expansion of its King of the Hills (KOTH) gold operation near Leonora, aiming to lift processing capacity and unlock more of the district’s long-life potential.

New Crusher and Mill Upgrades:

The project ...