$CYM

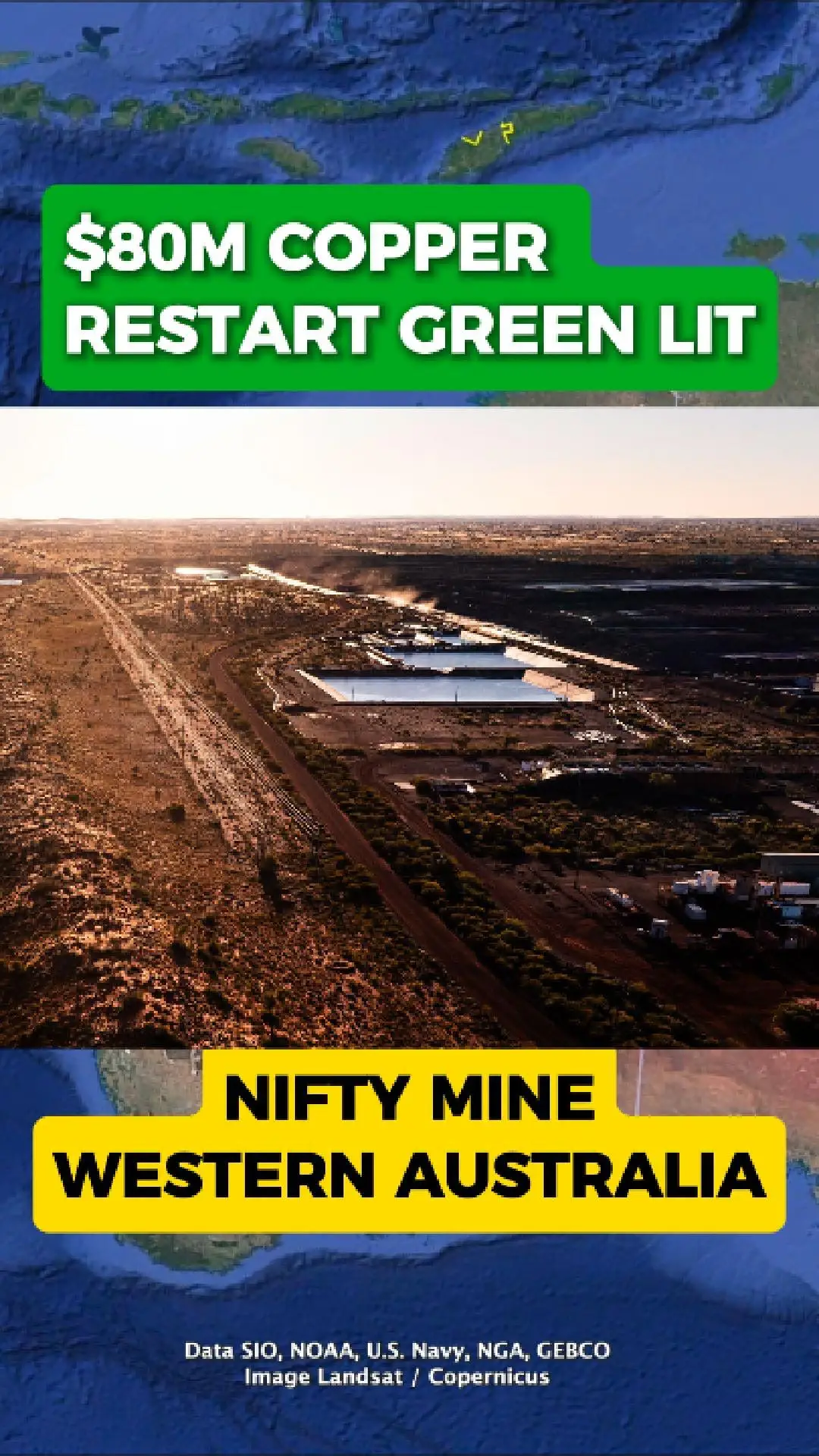

Nifty Copper Mine restart gets the go-ahead

Cyprium Metals says the Nifty copper mine — about 350km southeast of Port Hedland — is moving from “idle” toward a restart after receiving the green light to resume copper production.

Phase one: jobs first

Cyprium says the initial restart phase is expected to create 70+ ...

Cyprium Metals says the Nifty copper mine — about 350km southeast of Port Hedland — is moving from “idle” toward a restart after receiving the green light to resume copper production.

Phase one: jobs first

Cyprium says the initial restart phase is expected to create 70+ ...